Citizens Bank Cancer Awareness Webinar Press Release

30th January 2026, Kathmandu

Citizens Bank International Limited has reinforced its commitment to corporate social responsibility and employee welfare by launching a comprehensive cancer awareness initiative in early 2082. Partnering with the world renowned Medanta – The Medicity Hospital in Gurgaon, India, the bank organized specialized webinars focused on the prevention and early detection of breast and prostate cancer.

Citizens Bank Cancer Awareness

These sessions, facilitated by senior medical experts, aimed to empower over one thousand employees with accurate information and clarify common myths associated with the disease. While the bank leads in social health initiatives, its latest financial results for the second quarter of the fiscal year 2082 2083 reveal a challenging period marked by rising impairment charges and a decline in net profitability.

Health Empowerment: Employee Wellness Webinars

The Citizens Bank Cancer Awareness campaign was structured to address the specific health needs of its diverse workforce. By utilizing a digital platform, the bank ensured that employees across its nationwide network could participate in live, interactive sessions with specialists from Medanta Hospital.

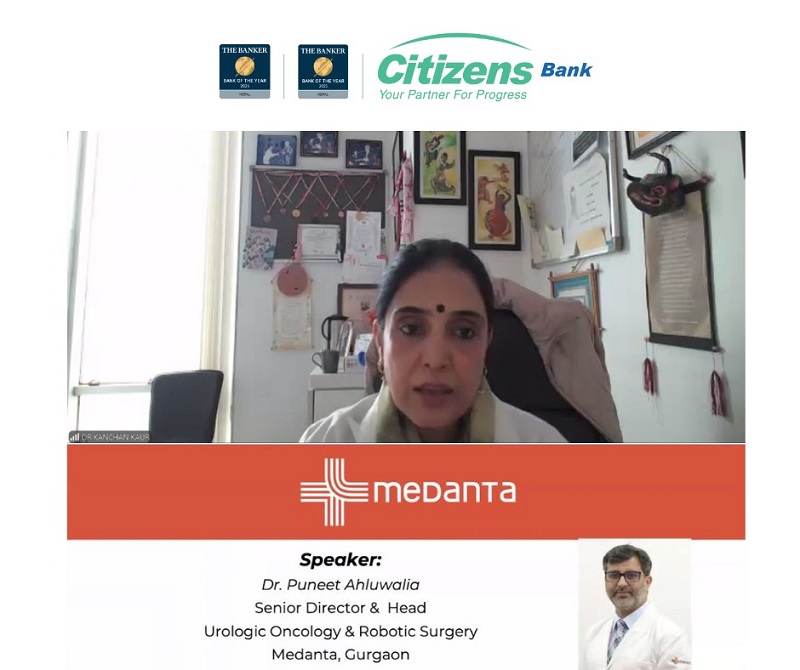

Breast Cancer Awareness: A dedicated webinar titled “What Women Should Know and Practice About Breast Cancer” was conducted on Magh 13, 2082. Dr. Kanchan Kaur, Senior Director of Breast Cancer at Medanta, led the session for 513 female employees. The discussion emphasized the importance of regular self examinations, clinical screenings, and the impact of lifestyle choices on long term health.

Prostate Cancer Awareness: On Magh 14, 2082, a separate session titled “Prostate Cancer: Myths and Facts” was held for 509 male employees aged 30 and above. Dr. Puneet Ahluwalia provided insights into early symptoms and the critical role of timely medical consultation in improving treatment outcomes.

Global Partnership Benefits: Beyond the webinars, Citizens Bank has extended a significant benefit to its cardholders, who are now entitled to a 15 percent discount on medical service charges at Medanta Hospital in India, facilitating easier access to high quality international healthcare.

Second Quarter Financial Performance Analysis

The financial report for the period ending in Poush 2082 (January 2026) paints a picture of a bank navigating a difficult credit environment. Citizens Bank International Limited reported a net profit of 358.85 million rupees for the second quarter, representing a 45.78 percent decline compared to the 661.82 million rupees earned in the same period of the previous fiscal year.

Impairment Charges: The primary reason for the profit decline was a 32.30 percent surge in impairment charges, which rose to 1.83 billion rupees as the bank adjusted for potential loan losses.

Operating Profit: Due to higher provisioning, the operating profit fell by 44.68 percent to stand at 504.17 million rupees.

Distributable Profit: A significant point of concern for investors is the reported negative distributable profit of 1.10 billion rupees, which may impact the bank’s ability to issue dividends for the current period.

Revenue Trends: Despite these pressures, net interest income saw a slight growth of 2.28 percent, reaching 3.14 billion rupees, though fee and commission income faced a sharp decline of over 57 percent.

Asset Quality and Balance Sheet Position

The balance sheet of Citizens Bank remains substantial, though loan and deposit growth has slowed in recent months. Total deposits stood at 210.22 billion rupees, a marginal decline of 0.60 percent from the previous year. Loans and advances to customers were recorded at 168.21 billion rupees.

Asset quality has weakened, with the non performing loan (NPL) ratio rising to 6.86 percent from 4.85 percent in the corresponding quarter of last year. This increase reflects the broader stress in the Nepalese economy, particularly affecting small and medium enterprises. The bank has maintained a capital adequacy ratio (CAR) of 12.43 percent, which remains above the regulatory minimum, providing a buffer as the bank works through its legacy assets.

Digital Innovation and Nationwide Network

Citizens Bank continues to distinguish itself through digital leadership and innovative retail products. It was the first in Nepal to launch the Citizens Fonepay Credit Card, a virtual credit solution that integrates with the widely used Fonepay network. Other recent innovations include:

Youth Banking: The Citizens Gen Z Savings Account is designed for younger customers, while the Freelancer Savings Account caters to the growing gig economy in Nepal.

Mobile Features: The Citizens Digi Bank platform now allows customers to manage share applications and CRN numbers directly through their mobile devices.

Expanding Access: The bank’s network has grown to include 200 branch offices, 169 ATMs, and 42 branchless banking units across 61 districts, serving nearly two million customers.

Conclusion and Future Outlook

In conclusion, the fiscal year 2082 2083 is a period of transition for Citizens Bank International Limited. While the bank has achieved excellence in corporate responsibility and digital innovation, its financial health is currently under pressure from high NPL levels and impairment costs. The successful execution of the cancer awareness program with Medanta Hospital demonstrates the bank’s long term vision for a healthy and productive workforce. For the remainder of the fiscal year, the bank’s focus will likely remain on aggressive loan recovery and cost optimization to restore its distributable profit to positive territory.

For More: Citizens Bank Cancer Awareness