Muktinath Bikas Bank Launches FAIDA Quiz Contest: Win Rs. 500 Top-Up Daily!

13th November 2025, Kathmandu

Muktinath Bikas Bank Ltd., a prominent leader in Nepal’s development banking sector, is skillfully utilizing the power of social media to deepen customer connections and enhance financial awareness.

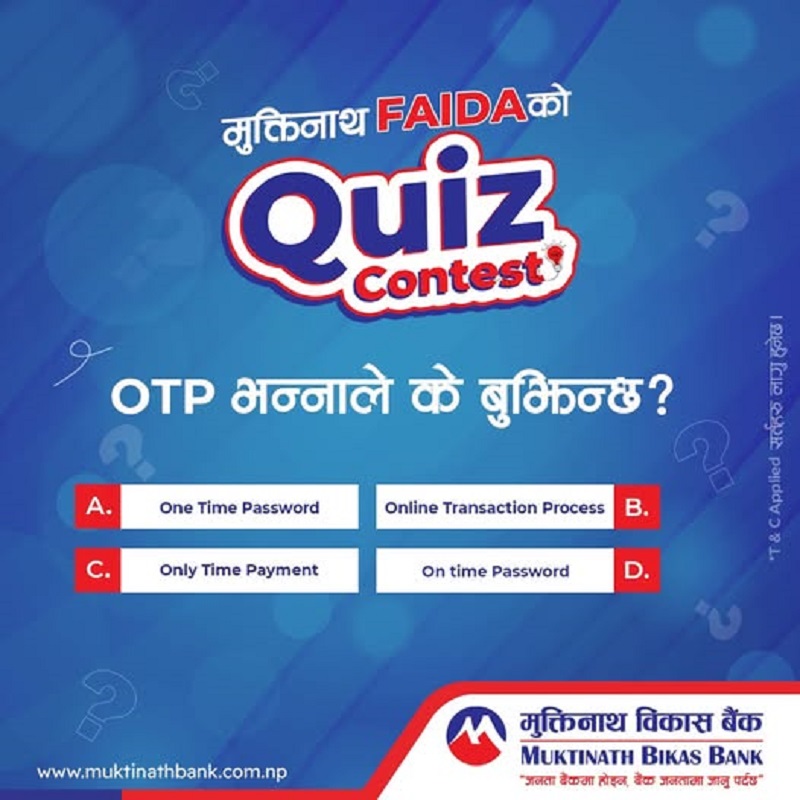

Muktinath Bank FAIDA Quiz

Their latest campaign, the “Muktinath FAIDA Quiz Contest” on Facebook and Instagram, is a stellar example of an interactive digital strategy that rewards engagement and promotes financial knowledge in a highly accessible way. Running until November 18, 2025, the contest is more than a prize giveaway; it is a strategic effort to build brand loyalty and foster a more informed community of digital banking users.

The Genius of Gamified Engagement: Muktinath’s Approach to Digital Rewards

The campaign’s success lies in its perfect blend of simplicity, reward, and visibility. By offering a daily prize of a Rs. 500 mobile top-up to two lucky winners—one from Facebook and one from Instagram—Muktinath Bikas Bank creates a persistent, high-frequency incentive. This daily draw encourages repeat engagement over the duration of the contest, ensuring the bank remains top-of-mind for its digital audience.

The structure of participation is deliberately straightforward to maximize reach and minimize friction, a key best practice for social media contests:

Like and Follow: Boosts the bank’s visibility and organic reach across two major platforms.

Answer and Hashtag: Requires minimal effort, but the mandatory use of the unique hashtag, #muktinathmafaidacha, ensures easy tracking of participants and contributes to trending visibility across social media feeds. The slogan “Muktinath ma FAIDA chha” translates to “There is benefit/advantage in Muktinath,” ingeniously reinforcing the bank’s value proposition through a catchy, memorable phrase.

Daily Opportunity: The continuous nature of the daily prize draw keeps the contest fresh and drives users to check the bank’s pages every day for the new quiz, significantly increasing overall page traffic.

This model of gamified engagement effectively addresses a challenge faced by many financial institutions: making banking and financial awareness topics interesting to a broad, often youth-centric, social media demographic.

Social Media as a Financial Literacy Catalyst

In the context of Nepal’s rapidly digitizing economy, financial institutions must move beyond traditional advertising. Social media is not just a marketing channel; it is a critical platform for financial education and inclusion.

The Muktinath FAIDA Quiz Contest subtly serves this educational purpose. While the questions may cover general knowledge, they are often strategically mixed with questions related to banking, digital services, or customer awareness. This forces participants to engage with content that is directly or indirectly related to financial literacy, payment systems, or the bank’s products.

Digital campaigns that offer value, such as educational content or interactive quizzes, are far more effective in connecting with the audience than purely promotional posts. By rewarding users for their knowledge, Muktinath Bikas Bank is positioned as a supportive, accessible, and modern financial partner, making complex financial concepts more approachable and less intimidating. This is particularly crucial in a market where financial literacy is key to driving the adoption of digital banking products, like the Muktinath FAIDA App itself, which is designed to enhance secure mobile banking services.

Strategic Impact on Brand Loyalty and Digital Footprint

For Muktinath Bikas Bank, the FAIDA Quiz Contest offers several long-term strategic benefits that transcend the immediate campaign period:

Expanded Digital Reach and SEO: The requirement for likes and follows broadens the bank’s social media audience, which, in turn, amplifies the reach of all future posts organically. The unique, branded hashtag builds a clear, searchable digital trail, effectively contributing to off-page SEO by creating social signals around the bank’s brand and its FAIDA services.

Customer-Centric Image: By consistently launching community-focused initiatives—which complement its established community-centered activities and programs like financial literacy campaigns and art competitions—the bank reinforces its reputation as a customer-focused institution. This trust is paramount in the competitive development banking sector in Nepal.

Data and Insight Generation: The quiz responses and engagement metrics provide Muktinath Bank with invaluable data on customer interests, engagement times, and preferred platforms, allowing them to refine future digital marketing strategies for greater effectiveness and personalization.

Muktinath Bikas Bank’s continuous investment in digital innovation and interactive communication is a forward-thinking approach. It recognizes that in today’s digital world, success is measured not only by the quality of financial products but also by the quality of the customer experience and the strength of the digital relationship. The bank’s commitment to transparency, fairness, and consistent customer connection through platforms like Facebook and Instagram positions it strongly for sustained growth and influence in Nepal’s evolving financial landscape.

For More: Muktinath Bank FAIDA Quiz