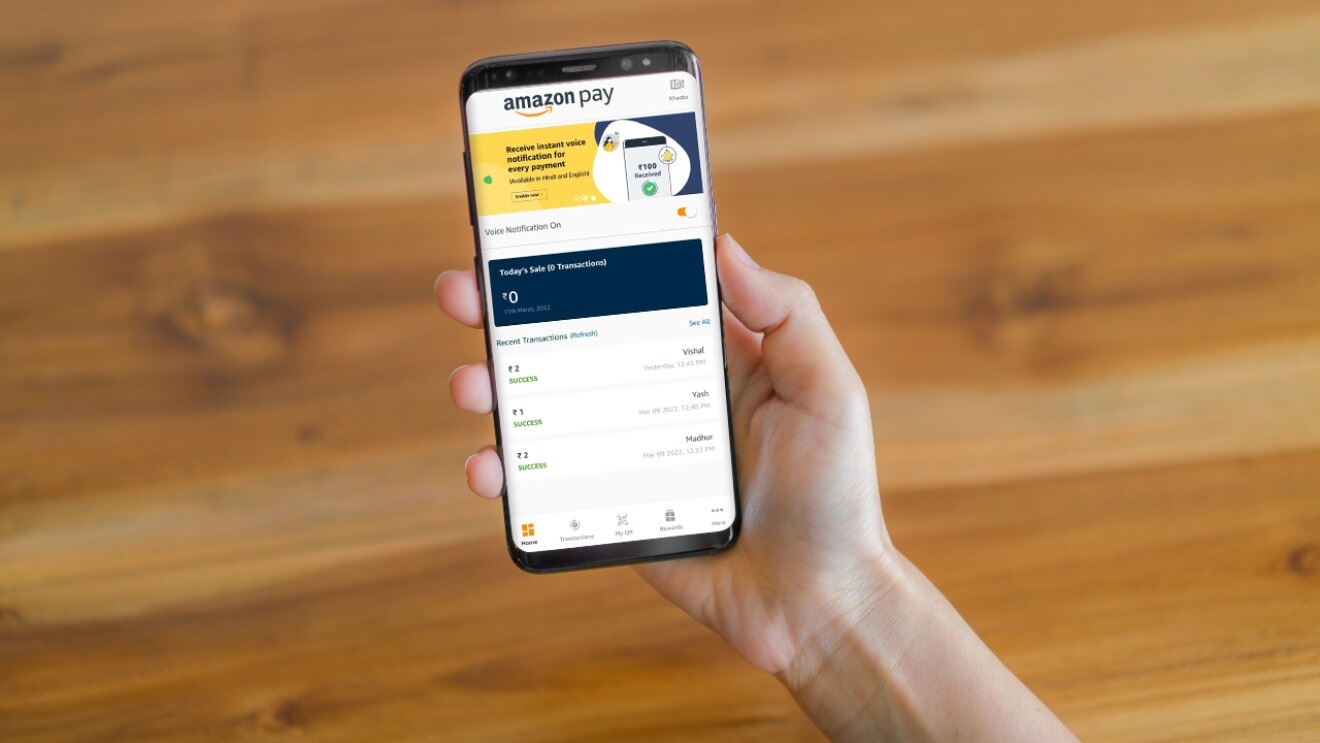

How to Add Money to Amazon Pay from a Mobile Device?

30th April 2023, Kathmandu

Amazon Pay is a digital wallet service provided by Amazon that allows customers to pay for goods and services online. It was introduced in 2007 and has since become a popular payment method for millions of Amazon consumers around the world.

Using Amazon Pay, users can make payments for various services, such as online shopping, bill payments, mobile recharge, and more, without the need to enter their payment details every time.

Here are some features and benefits of using Amazon Pay:

Easy and Convenient:

Amazon Pay offers a quick and easy way to make payments online. Users can make payments with just a few clicks, without the need to enter their payment details every time.

Secure:

Amazon Pay uses various security measures, such as encryption and fraud detection, to protect users’ payment information and transactions.

Cashbacks and Discounts:

Amazon Pay offers various cashback and discount offers on transactions made using their digital wallet.

Quick Refunds:

If a user needs to return a purchase made using Amazon Pay, the refund is credited to their Amazon Pay balance within a few hours.

Multiple Payment Options:

Amazon Pay offers various payment options, such as credit/debit cards, net banking, UPI, and other digital wallets. Making it easy for users to add money to their Amazon Pay balance.

Seamless Integration:

Amazon Pay is integrated with various websites and merchants, making it a convenient payment option for online transactions.

How to add money to Amazon Pay from a mobile device?

Adding money to your Amazon Pay account from your mobile device is a quick and easy process that can be done in just a few steps. Here’s a step-by-step guide on how to add money to Amazon Pay from your mobile device.

Step 1: Open the Amazon app on your mobile device and log in to your account.

Step 2: Tap on the three lines icon in the upper left corner of the screen to open the menu.

Step 3: From the menu, select “Amazon Pay” and then tap on the “Add Money” button.

Step 4: Enter the amount you want to add to your Amazon Pay balance and tap on the “Continue” button.

Step 5: Select the payment method you want to use to add money to your Amazon Pay account. You can choose from various options such as debit cards, credit cards, net banking, UPI, and other digital wallets.

Step 6: Enter the required details for your selected payment method and tap on the “Continue” button.

Step 7: Review the details of your transaction and tap on the “Add Money” button to complete the transaction.

Step 8: Once your transaction is complete, you will receive a confirmation message on the screen. Along with a transaction ID. You will also receive an email and SMS confirmation.

Why Add Money to Amazon Pay?

Amazon Pay is a digital wallet that allows you to make payments for various services. such as online shopping, bill payments, mobile recharge, and more. Additionally, Adding money to your Amazon Pay account offers several benefits, such as:

Easy Payments:

Adding money to your Amazon Pay account makes it easy to make payments for various services. You don’t have to enter your payment details every time you make a transaction.

Quick Refunds:

If you make a purchase using Amazon Pay and need to return it, the refund is credited to your Amazon Pay balance within a few hours.

Cashbacks and Discounts:

Amazon Pay offers various cashback and discount offers on transactions made using their digital wallet.

Safety and Security:

Amazon Pay uses various security measures to protect your account and transactions.

Conclusion

In conclusion, adding money to your Amazon Pay account from your mobile device is a simple process that can be completed in just a few steps.

Furthermore, By adding money to your Amazon Pay account, you can enjoy the benefits of easy payments, quick refunds, cashback, discounts, and enhanced safety and security.

So, the next time you need to make a payment, consider using Amazon Pay for a hassle-free and secure transaction experience.