Citizen Life Insurance IPO Results Unveiled: Multiple Ways to Access

8th August 2023, Kathmandu

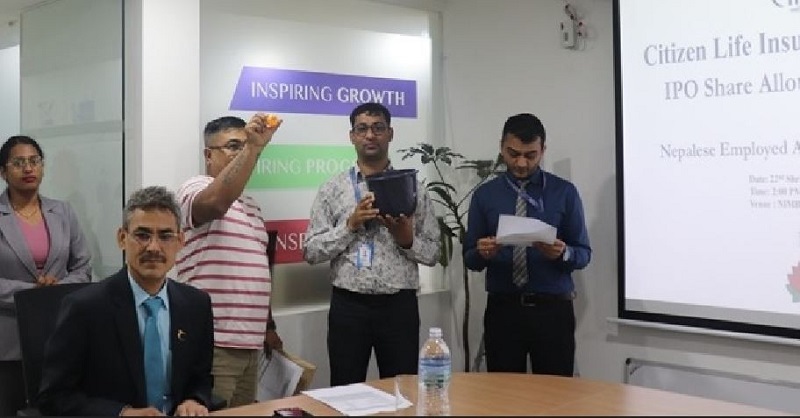

Citizen Life Insurance has successfully completed the allocation of its Initial Public Offering (IPO) for Nepali expatriates.

Citizen Life Insurance IPO Results

The company has partnered with NIMBS Capital, its sales manager, to execute the IPO allotment. Investors can access the results through two distinct channels.

Accessing IPO Results

The eagerly awaited IPO results of Citizen Life Insurance are available through two dedicated platforms:

NIMBS Capital:

Investors can access the results on the NIMBS Capital website at Click Here.

CDSC Website:

The results are also accessible through the official website of the Central Depository System and Clearing Limited (CDSC) at Click Here

IPO Allocation Overview

Citizen Life Insurance issued 1,125,000 shares to Nepali individuals employed abroad. The allocation process, managed by NIMBS Capital, garnered significant interest from applicants.

A total of 27,632 applications were received for this IPO, with four applications being canceled. Out of these, 27,628 individuals are eligible for share allotment.

In terms of share allocation, the breakdown is as follows:

Minimum Demand:

7,885 applicants requesting 10 to 40 shares received shares as per their demand.

Moderate Demand:

19,743 applicants asking for 50 to 2,000 shares were allocated shares at a rate of 40 shares.

A specific round-based system was employed for 19,743 applicants requesting 50 to 2,000 shares. From this group, 18,029 individuals received allotments at the rate of 10 shares per applicant. The maximum allotment was set at 50 shares per investor.

About Citizen Life Insurance

Citizen Life Insurance has rapidly emerged as a dynamic player in Nepal’s life insurance landscape. The company commenced its operations on October 19, 2017, after receiving the operating license from Nepal Beema Pradhikaran, the Insurance Regulatory Authority of Nepal.

With an authorized capital of NPR 5 billion, issued capital of NPR 3.75 billion, and paid-up capital of NPR 2.625 billion, Citizen Life Insurance operates under a 70:30 public limited company structure. It is primarily promoted by Kantipur Media Group, Shikhar Insurance, and various reputable entities across industries. The company’s widespread network comprises 140 branches/sub-branches, serving diverse regions of Nepal.

Citizen Life Insurance stands committed to customer satisfaction and innovation in insurance solutions. Its array of products caters to educational support, wealth accumulation, health and wellness, retirement planning, and financial security.

As the company embraces global practices with local adaptations, it strives to safeguard families’ futures and promote financial well-being for all its policyholders.