Citizens Bank Launches Virtual Credit Card: Zero Interest on Timely Payment

Citizen Virtual Credit Card

16th October 2025, Kathmandu

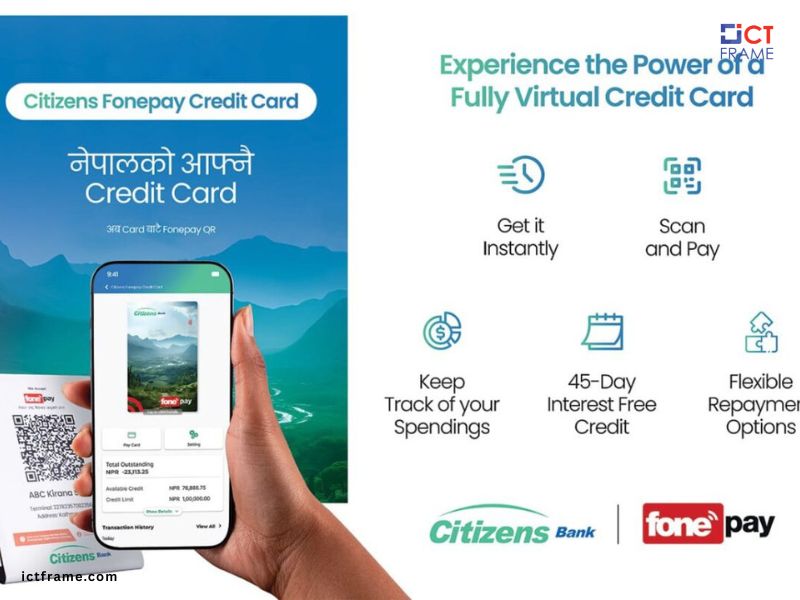

Citizens Bank International has launched a significant new digital product, the Citizens Virtual Credit Card.

Citizen Virtual Credit Card

This move adds a new dimension to the bank’s digital technology offerings. The bank initiated this service to provide its customers with more convenient, secure, and modern financial services.

This strategy considers the growing global trend toward digital banking. The virtual credit card now allows customers to easily shop and make payments without relying on physical cash.

This innovative service is primarily targeted at Citizens Bank’s existing customer base. The card enables instant payment by scanning a merchant’s QR code when purchasing goods or services.

Furthermore, customers who settle their monthly bills on time benefit from an interest-free loan facility. This important feature allows users to shop easily, even during short-term cash shortfalls.

Eligibility Criteria for the Virtual Card

The Citizens Virtual Credit Card is designed for Nepali citizens. Individuals must be at least 18 years old and possess a stable source of income to qualify.

Both salaried employees and self-employed individuals can apply. They must provide verifiable proof of their consistent earnings. This inclusive approach ensures wide accessibility.

New customers must complete the application form. They must also submit essential documents.

These include two passport-size photographs, a copy of their citizenship certificate or passport, proof of income, and bank account statements for the last six to twelve months. Providing this documentation is mandatory for the application to proceed.

Individuals with business income face specific requirements. They need to submit financial statements for the last two years.

Other required documents include the business registration certificate, PAN or VAT registration certificate, bank account details, and partnership agreements, where applicable.

Simplified Process for Existing Customers

The application process is simplified and faster for the bank’s current customers. Existing loan customers can access a virtual card facility with a limit of up to 2.5% of their loan amount or NPR 250,000, whichever amount is less. This provides quick liquidity access.

For customers who have fixed deposits (FD) with the bank, the virtual card limit is set at 50% of the FD amount or up to NPR 200,000. This option rewards savings customers.

Salaried customers whose payroll is managed through Citizens Bank can avail a facility up to 1.5 times their monthly salary.

They must provide proof of at least three months of salary credits to their account. Special customers of the bank receive a limit of up to NPR 100,000 or 10% of their average balance.

Low Fees, High Flexibility

Citizens Bank structured the fees for the Citizens Virtual Credit Card to be minimal. The card issuance and annual renewal fee is NPR 500. This keeps the cost of ownership very low.

There are penalty fees for delayed payments. Failure to pay the bill on time incurs a charge of NPR 300 or 1% of the monthly outstanding balance, whichever is higher.

Additionally, the remaining balance will accrue a monthly interest of 2%. However, the card remains completely interest-free for users who pay their bills promptly. This allows customers to utilize a short-term, interest-free loan facility effectively.

Advancing Digital Banking in Nepal

The launch of the virtual credit card marks a significant achievement for Citizens Bank. They have made notable progress in enhancing customer convenience through various digital services in recent years.

This new card follows the successful implementation of mobile banking, online payments, ATMs, and Fonepay QR services. The bank views the virtual credit card as its next major milestone.

The bank is actively introducing new products to promote the growing use of digital transactions in Nepal. The Citizens Virtual Credit Card continues this trend.

It eliminates the need for a physical card. Customers can easily pay at any Fonepay-affiliated merchant across the country using their mobile card details or by scanning a QR code.

Secure and Transparent System

Citizens Bank assures customers that the virtual credit card operates through a secure digital system. Card details are only available on a protected digital platform.

Special security protocols have been implemented to prevent unauthorized access. This protects user data diligently.

Customers can view and control their card details via the mobile banking app. They also have the immediate ability to block the card if necessary.

This feature instills complete confidence in the users’ digital security. The bank anticipates that this product will particularly appeal to customers who prefer QR payments for daily transactions.

It also targets those who avoid carrying cash for purchases. The service is expected to benefit young people, business professionals, and salaried individuals who seek greater ease in using digital channels.

The bank also plans to introduce various cashback offers, special discounts, and online promotions through this card in the future. These incentives will further attract customers toward using digital payment methods.

For more: Citizen Virtual Credit Card