Kamana Sewa Bikas Bank Digital Banking: Your Complete Online Solution In Nepal

11th July 2025, Kathmandu

Kamana Sewa Bikas Bank Ltd. is expanding customer convenience through its advanced digital banking services. These services allow customers to access banking facilities anytime, anywhere via secure electronic platforms.

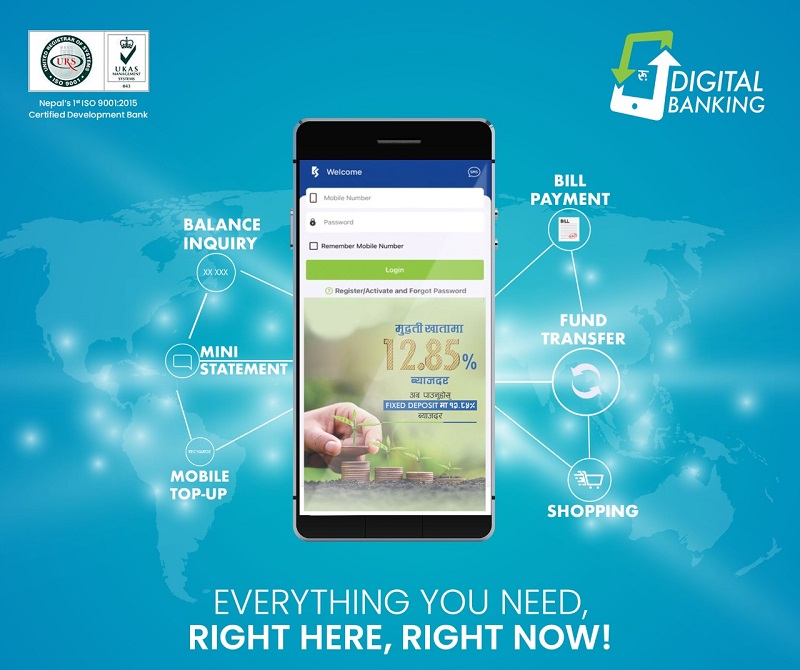

Kamana Sewa Bank Digital Banking

The bank offers multiple digital tools under its “Digital Banking Services” section. These include KS iMobile, a user-friendly mobile banking app, and KSBLL UPI Debit Card, which facilitates seamless digital payments. Additionally, customers can use QR Scan and Pay for cashless transactions and the KSBLL Visa Debit Card for wider online and offline use.

With these services, Kamana Sewa Bikas Bank ensures faster, safer, and more flexible banking. The initiative aligns with Nepal’s ongoing shift toward a digital economy.

KS iMobile

Kamana Sewa Bikas Bank Ltd. has unveiled KS iMobile, its advanced digital banking platform designed to deliver a smooth and secure banking experience across multiple devices. Whether customers prefer using their mobile phones or desktop browsers, KS iMobile ensures uninterrupted access to banking services anytime and anywhere.

The new platform offers a broad range of digital services to meet diverse customer needs. Users can easily view account statements, pay credit card bills, recharge mobile phones, transfer funds between banks, purchase digital vouchers, and even book tickets for airlines and movies directly through the app.

KS iMobile is available on both major platforms—App Store and Google Play—making it accessible to a wide range of smartphone users across Nepal.

To balance convenience with security, Kamana Sewa Bikas Bank has implemented transaction limits for users. Mobile app users can transfer up to Rs. 3,00,000 daily, with a monthly cap of Rs. 20,00,000. Browser users enjoy higher limits, with the ability to transfer Rs. 20,00,000 per transaction and up to Rs. 50,00,000 monthly.

Security remains a top priority for the bank. Customers are encouraged to regularly update their PIN codes, always log out after completing transactions, and refrain from sharing passwords with anyone.

KSBBL UPI Debit Card

Kamana Sewa Bikas Bank Ltd. (KSBBL) has introduced the KSBBL UPI Debit Card to provide customers with a secure and convenient way to make payments and access banking services. The card supports contactless payments and is accepted at ATMs and POS terminals displaying the SCT logo throughout Nepal and India. It is linked with the international Union Pay network, offering wider acceptance.

Features and Benefits:

Use the card for cash withdrawals, balance inquiries, mini-statements, and purchases at various merchants including departmental stores, hospitals, and retail shops.

EMV chip-based technology ensures secure transactions.

Valid for 4 years with easy renewal options.

Available to customers holding Savings, Current, Joint (with “Any One Signature” mode), or Sole Proprietorship accounts.

Fees and Charges:

The first year’s issuance is free; thereafter, an issuance fee of NPR 750 applies, payable either as a one-time payment or in three yearly installments.

Fees apply for card re-issuance, blocking, PIN regeneration, and other services at nominal rates.

Cash withdrawal is free from KSBBL ATMs but fees apply for other ATMs depending on location.

Transaction Limits:

ATM daily withdrawal limit is NPR 100,000 within Nepal and INR 10,000 in India.

POS daily transaction limit is NPR 300,000 within Nepal and INR 100,000 in India.

Limits are set to balance security and convenience.

Important Guidelines:

Always insert the chip card fully and wait until the transaction is complete before removing it.

Verify cash before leaving the ATM and keep transaction receipts for record-keeping.

Change your PIN regularly and never share your PIN or card with others.

Report lost or stolen cards immediately to KSBBL to prevent unauthorized use.

With KSBBL UPI Debit Card, customers enjoy a modern, reliable, and safe banking experience suitable for everyday financial needs across Nepal and India.

QR Scan & Pay

Kamana Sewa Bikas Bank Ltd. offers QR Scan & Pay, a fast and convenient mobile payment method. Customers and merchants can complete transactions by scanning QR codes through mobile apps.

KSBBL supports QR payments via Fonepay and WeChat-UnionPay platforms. Fonepay QR codes accept payments from eSewa and over 58 banks’ mobile apps, while WeChat-UnionPay QR codes handle international payments via WeChat and domestic payments through Khalti and IME Pay.

Transaction Limits:

Per transaction: NPR 200,000

Daily: NPR 200,000

Monthly: NPR 2,000,000

Daily transactions: Up to 100

This service promotes fast, secure, and cashless payments across Nepal.

KSBBL Visa Debit Card

Kamana Sewa Bikas Bank Ltd. offers the KSBBL Visa Debit Card for easy and secure payments across Nepal and India. The card supports contactless “Tap to Pay” and is accepted at ATMs and POS terminals displaying the VISA logo. Equipped with EMV chip technology, it ensures safe transactions and is valid for five years.

Eligibility:

Available to Savings, Current, Joint (“Any One Signature”), and Sole Proprietorship accounts.

Fees:

First-year issuance free

NPR 1,400 issuance fee from second year (one-time or installments)

Re-issuance fee NPR 350

Card block fee NPR 100

PIN re-generation fee NPR 100

Free cash withdrawal at KSBBL ATMs

Fees apply for other ATMs and VISA ATMs in India

Transaction Limits:

ATM withdrawal: NPR 25,000 per transaction, NPR 100,000 daily (Nepal)

POS limit: NPR 100,000 per transaction, NPR 300,000 daily (Nepal)

Tap to Pay limit: Rs. 2,000 per transaction

KSBBL Visa Debit Card offers a reliable payment solution for everyday banking locally and internationally.

Locker Services

Kamana Sewa Bikas Bank Ltd. provides Safe Deposit Locker facilities across Nepal to securely store your valuable belongings. Various locker sizes are available to suit different needs.

Required Documents:

Filled Locker Service Request Form with account details

Recent photographs

Citizenship certificate

For secondary applicants, updated KYC form and similar documents are needed

Available Branches:

Locker services are offered at many branches nationwide, including locations in Kathmandu, Butwal, Narayanghat, Pokhara, Province 1, Province 2, and the Western Region.

KSBBL ensures safe and convenient access to lockers for its customers across the country.

Smart Teller

Kamana Sewa Bikas Bank Ltd. introduces the Smart Teller service, designed to simplify cash withdrawals for its customers using the KS iMobile QR facility. This innovative technology eliminates the need for a cheque book or debit card, offering a smart, secure, and hassle-free way to withdraw cash.

With Smart Teller, customers can access their funds anytime through their mobile devices by simply scanning a QR code, ensuring a seamless banking experience without visiting an ATM or carrying physical cards.

Transaction Limits for Smart Teller:

Maximum amount per transaction: NPR 200,000

Daily withdrawal limit: NPR 200,000

Monthly withdrawal limit: NPR 2,000,000

Maximum number of transactions per day: 100

This service enhances convenience and security, supporting KSBBL’s commitment to providing flexible and reliable digital banking solutions.

Viber and Messenger Banking

Kamana Sewa Bikas Bank Ltd. offers Viber and Facebook Messenger Banking, enabling customers to access a variety of banking services through popular instant messaging apps. These free, internet-based platforms are available on Google Play and the App Store, allowing seamless interaction with the bank without visiting a branch.

To ensure security, all service requests from existing customers are verified via OTP (One-Time Password). After submitting a request, customers receive an OTP to confirm their identity before the bank processes the request.

How to Join:

On Viber: Scan the QR code provided by KSBBL.

On Facebook Messenger: Search for “Kamana Sewa Bikas Bank Ltd” and start interacting.

Key Services Available via Viber and Messenger Banking:

Opening Deposit Accounts (Savings and Fixed)

Updating KYC details fully or partially

Applying for Loans and checking loan eligibility

Managing Debit Card activities (renewal, blocking, replacement)

Handling Fixed Deposit services (new deposits, renewals)

Requesting services without physical visits (cheque book, statement copies, balance certificates, ATM requests)

Accessing customer support services

Exploring the bank’s products and services

Locating nearby branches and ATMs

KSBBL’s social banking services provide a modern, secure, and convenient way for customers to manage their banking needs anytime, anywhere through popular messaging platforms.

DEMAT

Since 2021, Kamana Sewa Bikas Bank Ltd has been licensed as a Depository Participant (DP), offering Demat services to customers. Key services include:

Opening Demat accounts

Dematerializing and rematerializing shares

Real-time portfolio viewing via Meroshare

Depositing, withdrawing, and transferring securities

Pledging and un-pledging shares electronically

These services provide secure and efficient management of investors’ securities in electronic form.

ASBA /C-ASBA

Kamana Sewa Bikas Bank Ltd. offers ASBA (Application Supported by Blocked Amount), a secure process for applying to IPO, FPO, and Rights issues. ASBA blocks the application money in the investor’s bank account until the securities are allocated, ensuring funds are not debited prematurely.

C-ASBA enhances this by centralizing the verification of bank and Demat account numbers, helping prevent duplicate applications, and assisting issue managers and registrars with monitoring and allocation.

Investors can apply online via Mero Share, an online platform developed by CDSC for registered shareholders using C-ASBA.

KSBBL provides C-ASBA registration free of charge at all its branches nationwide. To register, simply fill out the C-ASBA form and submit it to the nearest KSBBL branch.

Sale of Non- Life Insurance related to Loan Products

Kamana Sewa Bikas Bank Ltd. offers Non-Life Insurance through its Bancassurance service across all branches nationwide. This service helps customers secure their future by combining insurance with other financial products like personal loans.

The Bancassurance Unit provides comprehensive financial advisory under one roof, making it easier for customers to access insurance and banking services together. Customers benefit from convenient claim processes since they regularly visit the bank.

KSBBL Visa Credit Card

Kamana Sewa Bikas Bank Ltd. offers the KSBBL Visa Credit Card with EMV chip security and 3D secure online protection. Valid for five years, the card supports easy payments across Nepal and India, with flexible repayment and EMI options. Transaction alerts are sent via SMS and email.

Fees and Charges: The card has a joining fee, issuance fee, and annual fee of NPR 1,000 each. Replacement and limit enhancement fees apply, along with charges for PIN regeneration and e-commerce activation. Cash withdrawals incur fees based on ATM type, and late payment and over-limit fees are NPR 500 each. Interest on overdue payments is 2% per month.

Eligibility and Application: Nepalese citizens aged 21+ with minimum monthly income of NPR 25,000 are eligible. Foreign nationals with embassy registration can also apply. To get a card, visit a KSBBL branch, submit documents, and collect your activated card.

Important Terms: The card is bank property and non-transferable. Lost or stolen cards must be reported immediately. Cardholders are responsible for all transactions until reporting loss. The bank can amend terms and fees with notice. Use of the card after cancellation is fraudulent.

Conclusion

Kamana Sewa Bikas Bank Ltd. continues to lead the way in Nepal’s banking sector by offering a wide range of advanced and customer-centric digital banking services. From secure mobile banking and versatile debit and credit cards to innovative payment solutions like QR Scan & Pay and Smart Teller, the bank ensures convenience, security, and flexibility for its customers.

Its social banking platforms through Viber and Messenger, comprehensive Demat services, and supportive investment options like ASBA further demonstrate KSBBL’s commitment to meeting the evolving financial needs of individuals and businesses alike.

Through its extensive branch network, including locker facilities and bancassurance services, KSBBL delivers a seamless blend of traditional and modern banking, empowering customers with easy access to financial products and personalized support. By continuously embracing technology and innovation, Kamana Sewa Bikas Bank stands as a trusted partner in Nepal’s journey toward a fully digital economy, fostering financial inclusion and growth for all.

For more:- Kamana Sewa Bank Digital Banking