Kumari Bank Fonepay Credit Card: Nepal’s First Digital, Virtual Credit Card

1st July 2025, Kathmandu

Fonepay and Kumari Bank Limited have signed a Memorandum of Understanding (MoU) to officially launch the Fonepay Credit Card—Nepal’s first fully digital and virtual credit card.

Kumari Bank Fonepay Credit Card

This innovative card is completely paperless. It offers instant application and approval directly through Kumari Bank’s mobile banking app. It is a breakthrough in Nepal’s journey toward a cashless, inclusive digital economy.

A New Era In Digital Credit

The Fonepay Credit Card introduces a fresh way for people to access credit. Users can now apply online, get immediate approval, and start using the card—all within minutes. There’s no need for physical documents, branch visits, or waiting in line.

The virtual credit card is stored securely in the user’s mobile banking app. It can be used for digital transactions across Fonepay’s vast merchant network. The entire experience is seamless, secure, and user-friendly.

How Does It work?

Eligible Kumari Bank customers can apply for the Fonepay Credit Card directly from their bank’s mobile app. After a quick verification, they receive instant approval. Once activated, the card is available virtually, ready for use without any physical version.

Users can manage their credit card limits, monitor spending, and make payments digitally. The system integrates smoothly with Nepal’s existing digital payment infrastructure. It supports QR payments and online purchases, and will eventually offer recurring billing options.

Why It Matters?

This digital-only card fills a long-standing gap in Nepal’s credit market. Many eligible individuals could not access credit due to complex paperwork and long processing times. Now, with just a smartphone and a bank account, credit becomes easier to obtain.

Fonepay and Kumari Bank aim to democratize credit. Their goal is to make financial services more accessible, especially to young professionals, digital-savvy users, and underserved communities. This card provides convenience, speed, and transparency.

A Shared Vision For Inclusion

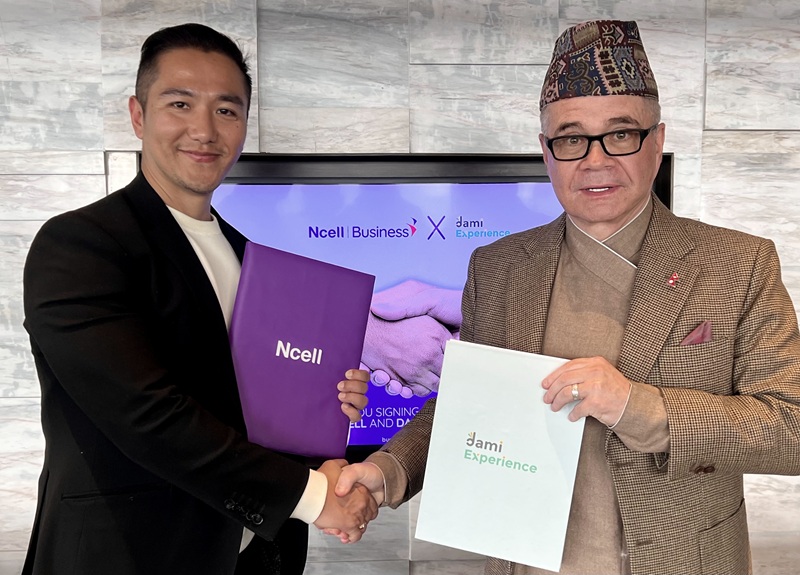

At the MoU signing event, officials from both organizations shared their excitement.

“We want to make credit inclusive, secure, and effortless,” said a Fonepay spokesperson. “This card is a major leap forward. We are putting power into the hands of every Nepali.”

Kumari Bank highlighted its drive to modernize banking. “This partnership reflects our dedication to digital innovation. It helps us meet the evolving needs of our customers,” said a senior Kumari Bank official.

Together, they see the Fonepay Credit Card as a step toward bridging the digital divide.

Security And Simplicity First

The virtual credit card uses robust encryption and security protocols. Since there is no physical card, the risk of theft or misuse decreases. Users can lock and unlock the card with a single tap through the mobile app. They also receive real-time notifications for each transaction.

Moreover, the entire process reduces dependency on paper. This supports sustainability and promotes eco-friendly banking practices.

Supports The Government’s Digital Economy Goals

This launch aligns with Nepal Rastra Bank’s vision for a digital-first financial system. It encourages digital payments and improves access to formal credit. The move supports the national goal of achieving a cashless economy.

Fonepay and Kumari Bank are committed to helping Nepal reach that future. Their collaboration shows what local fintech and banking institutions can achieve together.

Boost To Fintech Innovation In Nepal

The Fonepay Credit Card sets a new benchmark for Nepal’s fintech sector. It opens the door for more virtual banking services in the future, such as digital lending, virtual debit cards, and smart credit scoring models.

Nepal is witnessing rapid growth in mobile payments and e-commerce. This card will support that growth and encourage more people to engage in formal financial services.

Next Steps For Customers

Starting this month, eligible Kumari Bank customers can apply for the Fonepay Credit Card from their mobile banking app. The onboarding process is simple and takes only a few minutes. After activation, the card can be used immediately for digital payments.

Fonepay will continue to expand its features in future updates. Customers can expect more merchant tie-ups, loyalty programs, and better user controls.

About Fonepay

Fonepay is Nepal’s largest digital payment network. It provides interoperable payment solutions to banks, financial institutions, and merchants across the country. Fonepay enables QR payments, utility bill payments, and digital wallets through its network.

About Kumari Bank Limited

Kumari Bank Limited is a leading commercial bank in Nepal. Known for its customer-first approach and digital innovations, the bank offers a wide range of financial services. These include retail banking, SME loans, digital banking, and payment solutions.

Conclusion

The Fonepay Credit Card, powered by Kumari Bank, is more than just a digital product. It symbolizes Nepal’s bold step toward financial inclusion, digital access, and modern credit systems. With this innovation, Nepal joins the global movement of virtual finance, tailored for local needs and powered by local visionaries.

Nepali users now have credit access at their fingertips, without paperwork or delays. It’s a proud moment for Nepal’s digital banking ecosystem, and the beginning of smarter, simpler finance.

For more:- Kumari Bank Fonepay Credit Card