KYC Update Online Bank Made Fast and Easy with Global IME Bank

27th January 2026, Kathmandu

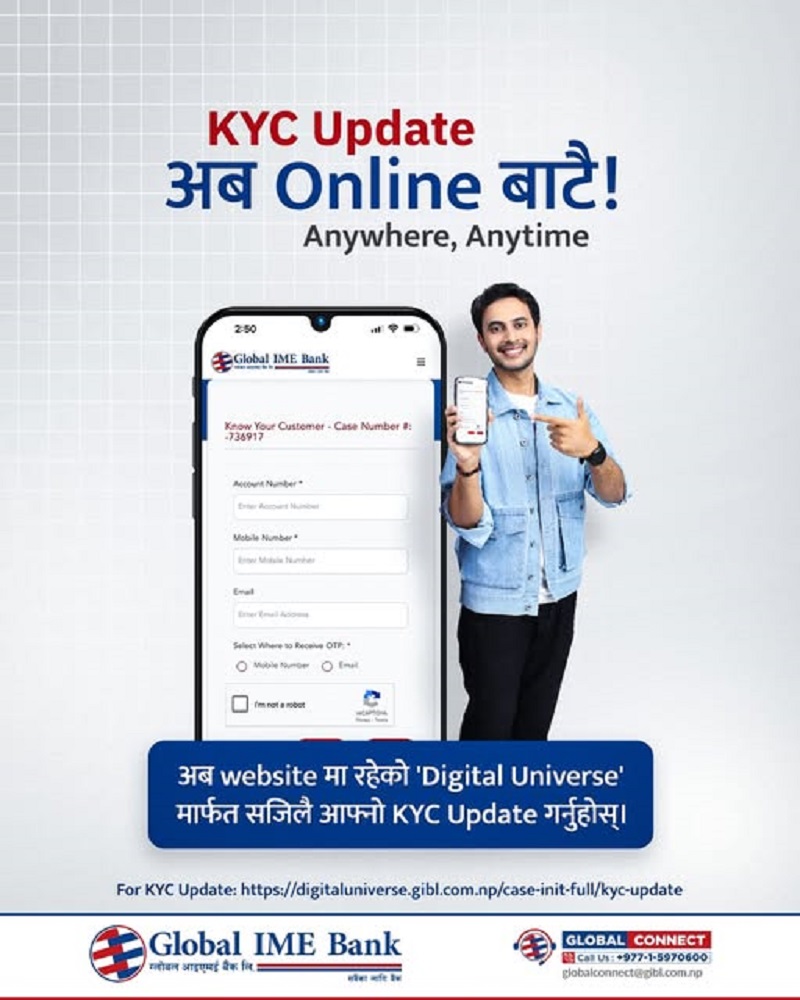

The landscape of retail banking in Nepal is witnessing a major shift toward automation and remote accessibility. Leading this change, Global IME Bank has introduced a sophisticated online KYC update system within its Digital Universe platform. This initiative is designed to solve one of the most persistent inconveniences for bank customers: the mandatory periodic update of Know Your Customer (KYC) details. By moving this process online, the bank has effectively removed the need for physical branch visits, allowing its millions of users to maintain their accounts from anywhere in the world.

KYC Update Online Bank

As of January 2026, the Nepal Rastra Bank has tightened regulations regarding account transparency, making up to date KYC a non-negotiable requirement for active banking. Global IME Bank’s response through its “Digital Universe” not only ensures compliance but also sets a new benchmark for customer convenience in the digital age.

The Core Features of the Digital Universe Platform

The Digital Universe is not just a portal for KYC; it is a comprehensive ecosystem for digital banking services. However, the KYC update module is its most utilized feature. The system is built on an “E-KYC” framework that allows for the real-time verification of personal data.

Key features of this online system include:

Remote Access: Whether you are a migrant worker in the Middle East or a student in a remote district of Nepal, you can log in via a smartphone or laptop.

Data Security: The bank employs multi-factor authentication (MFA) and high-level encryption to ensure that sensitive documents like citizenship cards or passports are protected during the upload process.

Paperless Efficiency: By digitizing the form-filling process, the bank has significantly reduced the administrative overhead and environmental impact of paper-based documentation.

How to Update Your KYC Online: A Step-by-Step Guide

The process is designed to be intuitive, even for users who are not traditionally tech-savvy. To successfully update your records, follow these standard steps within the Digital Universe portal:

Access the Portal: Visit the official Global IME Bank website and navigate to the Digital Universe section, or go directly to https://www.google.com/search?q=digitaluniverse.gibl.com.np.

Login and Verification: You will need to enter your registered mobile number or email address. A One-Time Password (OTP) will be sent to verify your identity.

Navigate to E-KYC Services: Under the “E-KYC Services” menu, select “KYC Update.”

Data Entry: Review your existing information. If your address, occupation, or contact details have changed, update them in the respective fields.

Document Upload: Scan or take a clear photograph of your original Nepali Citizenship Certificate (both sides) or a valid Passport. You may also need to upload a recent digital photograph and a digital copy of your signature.

Final Submission: Once all fields are verified, submit the application. You will receive a reference number to track the status of your update.

The Strategic Shift Toward Video KYC (V-KYC)

In addition to basic information updates, Global IME Bank has pioneered Video KYC in Nepal. This is particularly useful for new account openings or for customers whose accounts have been blocked due to long-term inactivity. Through V-KYC, a bank representative conducts a live video interaction with the customer to verify their physical presence and original documents. This eliminates the last remaining reason for a customer to visit a physical branch, making Global IME a truly “borderless” bank.

Benefits for Different Customer Segments

The online KYC update system offers specific advantages to various groups of people:

Non-Resident Nepalese (NRNs): For those living abroad, visiting a branch was previously impossible. Now, they can keep their NRN savings accounts active with a few clicks.

Business Professionals: For busy individuals, the ability to update records during a lunch break or after office hours is a significant time-saver.

Rural Inhabitants: In areas where the nearest branch might be hours away, the Digital Universe platform provides an essential bridge to modern financial services.

Operational Excellence and Future Outlook

By shifting the majority of KYC updates to the digital realm, Global IME Bank has optimized its branch resources. Branch staff can now focus on more complex tasks, such as loan processing and investment counseling, rather than manual data entry. This operational efficiency is a key reason why the bank continues to lead in terms of total assets and customer base in Nepal.

The bank’s Information Officer and management team have emphasized that this digital push is part of a “Green Banking” philosophy. Reducing the carbon footprint associated with physical documentation and travel is a core goal for 2026. As artificial intelligence and machine learning become more integrated into the portal, customers can expect even faster processing times and personalized banking insights based on their updated profiles.

Conclusion

The KYC update online bank service from Global IME Bank is a clear indicator that the future of banking in Nepal is digital. By combining robust security with a user-friendly interface, the Digital Universe platform has made financial compliance a seamless part of the customer experience. As the bank continues to innovate, its commitment to “providing a banking experience anytime, anywhere” remains more relevant than ever.

For More: KYC Update Online Bank