National Life Insurance Policy Gifted to Daughter on Birthday: A Shift Toward Meaningful Financial Security

15th December 2025, Kathmandu

The act of gifting can take on lifelong significance when the gift itself is a form of risk protection, providing enduring satisfaction for both the giver and the recipient. There is a perceptible and positive shift in consumer behavior in Nepal, driven by insurance professionals, which promotes the practice of gifting insurance policies instead of traditional physical items such as expensive goods, jewelry, or other quickly consumable valuables on major occasions like birthdays, weddings, and festivals.

Meaningful Financial Security

This emerging cultural trend recognizes that funds typically spent on expensive, temporary, or depreciating assets can be redirected into life insurance policies that offer comprehensive long-term financial benefits. This growing culture of gifting life insurance is increasingly viewed as a highly meaningful approach to ensure long term human and financial security for family members, often extending the benefit across future generations. This approach transforms a celebratory expenditure into a secured investment in the future.

The Bal Amrit 4 Policy: A Gift of Guaranteed Future

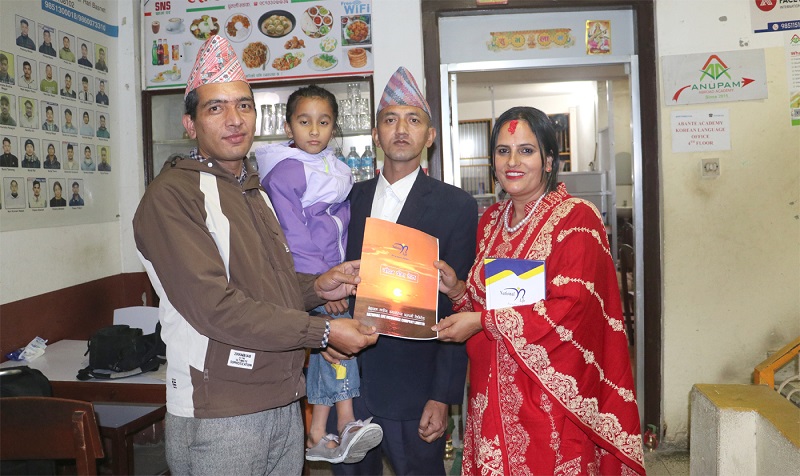

In a notable example of this meaningful shift, Sunita Nepal, the proprietor of Palpali Cafe located in Bagbazar, Kathmandu, chose to make a profound statement on her daughter’s birthday by presenting her with a life insurance policy.

The Gift of Protection: She gifted her daughter, Samriddhi Nepal, a National Life Insurance “Bal Amrit 4” policy. The policy was secured with a substantial sum assured of 750,000 Nepalese Rupees, demonstrating a significant commitment to her daughter’s future.

Rationale for the Choice: Sunita Nepal stated that her decision to insure her daughter on her birthday was motivated by the policy’s structure, which offers excellent life insurance coverage specifically focused on children’s education, health, and overall security. The Bal Amrit 4 plan is a highly popular offering because it provides crucial risk coverage for both the child and the proposer under a single policy, ensuring continuity of the child’s financial plan even under challenging circumstances for the parent.

Dual Coverage Mechanism: The Bal Amrit 4 policy, being a child plan, typically functions as an endowment assurance plan with profit. A key feature is the dual coverage: the proposer (parent) is insured immediately, while the child’s life coverage starts later, often after two years or upon the child reaching a certain age. Crucially, if the proposer meets an untimely death, the policy ensures that all remaining premiums are waived while the policy remains active, and the child often receives a monthly income (for example, 1 percent of the Sum Assured) to cover immediate needs until the policy matures. This is the mechanism that guarantees the child’s education and upbringing even in the absence of the financial provider. The full Sum Assured plus accrued bonus is paid to the child on maturity, regardless of the proposer’s survival.

The Agent’s Perspective on Social Responsibility

Deepak Baral, an agency representative of National Life Insurance, participated in the policy handover and provided context for the growing importance of such gifts.

Pillars of Tomorrow: He emphasized the societal importance of children, stating that they are the pillars of tomorrow and must be provided with proper education and values. He explained the protective function of the policy, noting that while parents are present, the policy acts as a disciplined way to create a dedicated fund for their children’s future.

Guaranteed Education: Baral highlighted the policy’s protective guarantee, stressing that since “no one knows what tomorrow holds,” the Bal Amrit child insurance ensures a guarantee for the child’s education and upbringing even if an unforeseen event occurs that takes the life of the proposer. He drew a parallel between the insurance and the concept of a guaranteed life source, stating, “Just as nectar gives life, this insurance guarantees proper education and care for children.”

Praise for the Gifter: He publicly thanked Sunita Nepal for her thoughtful and financially sound decision, acknowledging her for choosing to redirect daily expenses and prioritize the future by insuring her daughter with a life insurance policy worth 750,000 Nepalese Rupees on the special occasion of her birthday. This action serves as a strong example for others to follow, demonstrating how consumption can be shifted towards long-term savings and protection.

The choice to gift a life insurance policy represents a modern, responsible, and meaningful approach to celebrating life’s milestones, offering a gift that provides security and financial stability for years to come, long after any material gift would have lost its value.

For More: Meaningful Financial Security