The Impact of COVID-19 on the Real Estate Industry Nepal

23 January 2021, Kathmandu

Profits of big companies are set to decline in the current fiscal year. According to a review by the Large Taxpayer’s Office, profits are lower than last year.

In the first installment of income tax for the current year, the big companies have filed 32 percent less revenue than last year.

Traders in the open market have estimated that there will be no profit on average after the last fiscal year after the hard work of the covid infection.

It is estimated that the profits of many state-owned enterprises will also decline. Nepal Oil Corporation has filed the highest income tax of Rs 1 billion. The Civil Aviation Authority has not been able to pay significant taxes during this period.

Furthermore, the Telecommunications Authority has not filed any income tax this year. While Nepal Telecom has filed Rs 1.60 billion. Ncell has filed Rs 952 million.

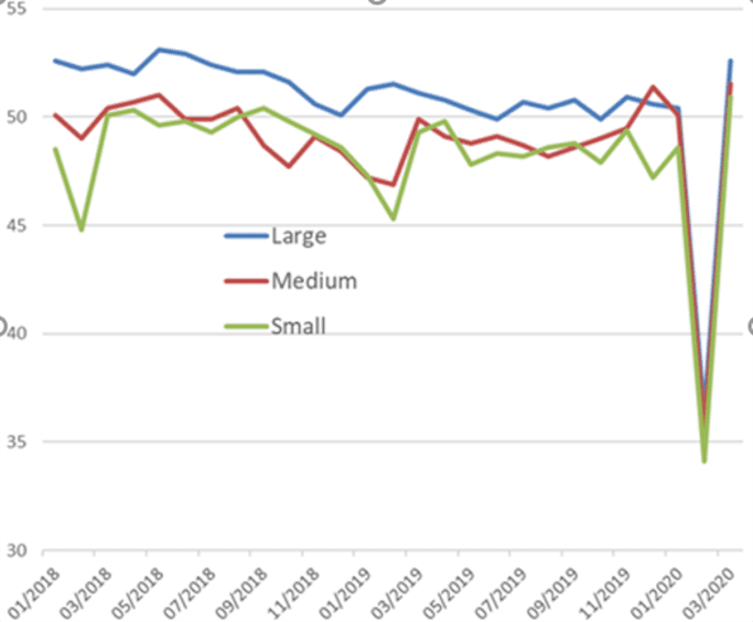

Banks and financial institutions have also seen a decline in profits due to covid. Many industries affected by covid-19. They are pushing the time to pay interest.

This has reduced the net interest income and increased the cost of loss management due to non-recovery of loans.

The provision of mandatory branch opening at the local level has increased the expenditure while the NRB has been delaying the sources of income lately.

In the first six months of this year. Corporate income tax is expected to be 32 percent lower than last year. According to the Office of the Large Taxpayer. Of the 43.43 billion advance income tax collected last year. Only 29.13 billion has been collected this year.

According to the office, government corporations have filed revenue of Rs 1.96 billion for the first installment of the estimated profit this year.

This is 70% less than last year. Similarly, the public limited company has filed revenue of Rs 1.69 billion. This is 23 percent less than last year. And private companies have filed Rs 8.60 billion.

This is 29 percent less than last year. Other companies have paid Rs 16.27 billion in revenue. This is 32 percent less than last year. However, last year, Ncell filed an income tax of Rs 22 billion, which is less than the current year.

Capital

Gains Tax Increases by 200 Percent As the share market and real estate transactions continue to increase during the Covid period, the tax arising from it has also increased.

They have filed Rs 210 million this year after paying Rs 70 million in taxes on real estate and share transactions from large households last year.

There has also been a decline in personal income tax, social security tax, and wage tax collection.

10 percent improvement in VAT collection.

The collection of value-added tax (VAT) has improved by 10 percent. The big tax payer’s office alone has collected 24.22 billion VAT in six months.

21.84 billion during the same period last year. In the manufacturing sector, VAT collection has improved by 12 percent. Similarly, there is an increase of 17 in trading. Counseling, on the other hand, declined by 26 percent.

Similarly, the communication technology business has improved by 27 percent due to the inability of the tourism sector to pick up speed.

Further, investment income tax has declined by 24 percent. Rent tax is negative at 30%. Corporate capital gains tax fell 98 percent as interest rates improved by 2 percent.

Similarly, the dividend tax of banks and financial institutions has improved by 20 percent. Other income taxes have improved by 36 percent.

Likewise, excise duty under large taxpayers’ offices has improved by 62 percent. It does not include excise duty on alcohol and tobacco.

Also, the education sector has collected 54 percent less tax than last year. And there has been a 73 percent decline in health.