NCHL Reduces Transaction Fees of Connect-IPS

1st December 2021, Kathmandu

To support the rollout of Retail Payment Switch, as part of the National Payment Switch (NPS), Nepal Clearing House Ltd.

NCHL has further reduced the transactions fee in a connect-IPS system from 7th Mangsir 2078 (23rd November 2021).

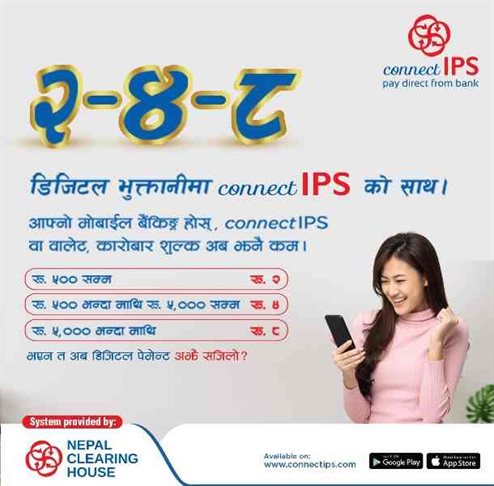

With the new structure, the transaction fee that applies to the banks & financial institutions’ customers and payment service providers (PSPs) has been reduced to NRs 2-8, based on the transaction amount.

Transaction fee for an amount up to NRs 500 has been set as NRs 2, for an amount more than NRs 500 & up to 5,000 has been set as NRs 4, and for the amount above NRs 5,000 has been set as NRs 8.

This will directly ease the customers for fund transfer from any of the channels of NCHL, including connect-IPS web, mobile app, CORPORPATEPAY; BFI’s mobile & internet banking; PSP wallets for cash In/Out; and various service payments.

GoN Inland Revenue tax payment is already cross-subsidized at NRs 2-5.

NCHL has been regularly revising the transaction fees based on the expected growth in digital payments and facilitating the ecosystem, which is in line with Nepal Rastra Bank’s policy direction for promoting digital transactions.

NRB has recently directed the BFIs to set the fund transfer fee in their mobile banking at NRs 10 to 30.

NCHL has seen transaction growth of over 225% in transaction volume and value of connect-IPS in the first four months of this fiscal year.

The average daily transaction value and volume in connect-IPS in the current fiscal year is over NRs 8.3 billion and 117,012, respectively, which is expected to grow further.

The transaction fee revision is expected to have a larger impact on the usage of real-time retail payments initiated from any of the alternate online channels.

NCHL has been operating various national payment systems, namely Electronic Cheque Clearing, Interbank Payment System, connect-IPS, connect-RTGS, National Payment Interface and CORPORATEPAY, facilitating the digital payments across Nepal under a collaborative infrastructure sharing principle. And, National Payment Switch is also expected to be rolled out soon to establish interoperability for retail payments, including infrastructure, instruments, and services. NCHL is supporting the BFIs and PSPs for their readiness.

For more information, please visit www.nchl.com.np or www.connectips.com.