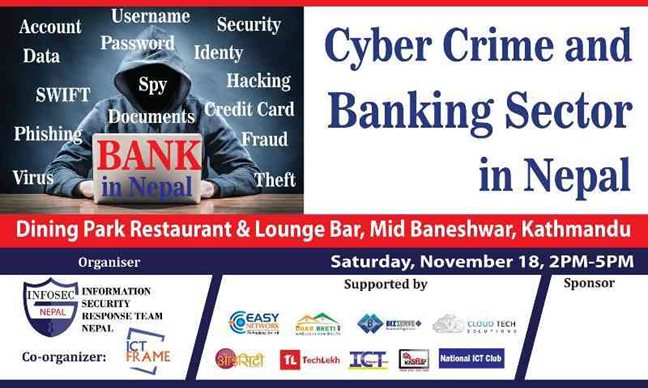

Upcoming Event, Cyber Fraud And Banking Sector In Nepal

Presented By Dr. Pramod Parajuli

Abstract

With the revolution in the communication sector, internet has been the boon to the mankind in the day to day life. Today activities performed over the internet are not just limited to technology freaks for technical uses, rather every second individual is enjoying the easy internet availability and accessibility for day-to-day purposes like banking, ecommerce, education, entertainment and many more.

Almost every sector these days enjoys the privileges of the internet. Banking sector too rides on the internet to bring up the significant change. The significant change can be seen in the banking service and the customer relation. All these glimpses can be seen on people using the mobile technology via internet on their day to day work.

Despite all the beneficiary, there comes the threat at the equal amount. With the expansion of the computers and internet, itleads to the new form of crime “Cyber Crime” and over the period of the time it has been more sophisticated and complex and Banking sector are too vulnerable to the threats the internet possesses.

Content

Cyber-crime is broadly classified into the various part. Hacking, Email spoofing, Spamming, Dos Attack are the few examples of it.However, from the aspect of financial cyber-crimes committed, the following categories present as the strongest:

- Miss Handling: While there are numerous threats aimed at bank systems and their customers, one of the biggest threats, and often one of the hardest to detect, is that of malicious, careless and compromised users. These employees, contractors and partners are already inside the banks secure perimeter and have legitimate access to its sensitive data and IT systems.

- ATM Fraud:ATM attacks and fraud continue to make headlines, despite the fact that the technology running ATM networks is becoming more secure. But exactly is the ATM Fraud? Far from being just a cash smash and grab, ATM are exposed to the other threat as well. Few of them are Card trapping, Cash trapping, physical attacks, logical attack.

- System Hacking: This thing is not new as we often hear the hacking word. The system hacking possesses the great amount of threat as all the data that are important to the customer as well as the service provider are vulnerable. Recent news of the hacking of the bank’s swift code made the threat more imminent in the banking sector.

- Card skimming: Card skimming involves the capturing of the data from the magnetic tape of the ATM card. This involves installing the skimming device in the ATM machine during the quiet period. This helps to capture the user data. Once the user data is captured,the “PIN” is used to withdraw money from accounts.

Protection to the threats possessed:

- Miss Handling: This threat is basically possessed within the organization. To overcome this, the good company policy is required. Employee should perform their work through the code of the conduct of the organization, along with maintaining the proper work ethics mentioned by the organization.

- ATM Fraud: Bank should provide an alert whenever they find any irregular card activity. The other aspect of the ATM Fraud is customer themselves. Customers must be requested to avoid the suspicious people during their transaction in the ATM Centre. Regular change to their confidential “ATM PIN” number can help in reducing the cardfraud.

- Card skimming: The only way to prevent having your ATM card skimmed is to recognize that the machine has been tampered with. However, bank should be monitoring the ATMs regularly.Any tampering with the ATM devices should be taken in consideration and immediate steps are to be opted to protect customer from the card skimming.

The other threats that are possessed by the bank are the Bank information security. Mobile ranking risk, DDosAttack, Malware in the network, Card skimming.

Tips to Fight Fraud in Banking Sector

- Bank should monitor every transaction made. Limiting the transaction of the customer via internet, Withdrawal Limitation from the ATMs’ are the steps that can be considered.

- Multifactor authentication: Every bank should have multi factor authentication process to ensure whether the customer is genuine or not. Multi-layered security like sending verification code to the telephone number attached to the account can be helpful in fighting the cybercrime.

- It is careful while opening the attachment when it comes from the unknown sender. Some hacking is done through the attachment where the virus is planted.This is not new as this type of attack are done in the previous years.

- Bank should keep their operating system up to date as update Operating system brings out the updated security in the system.

- Whenever customer feels insure in any transaction they should directly contact the bank officials. Banks should be active enough to hear these frauds complain and act accordingly.