What is Inflation: Concept, Causes and Measurement

Inflation is a measure of the rate of rising prices of goods and services in an economy.

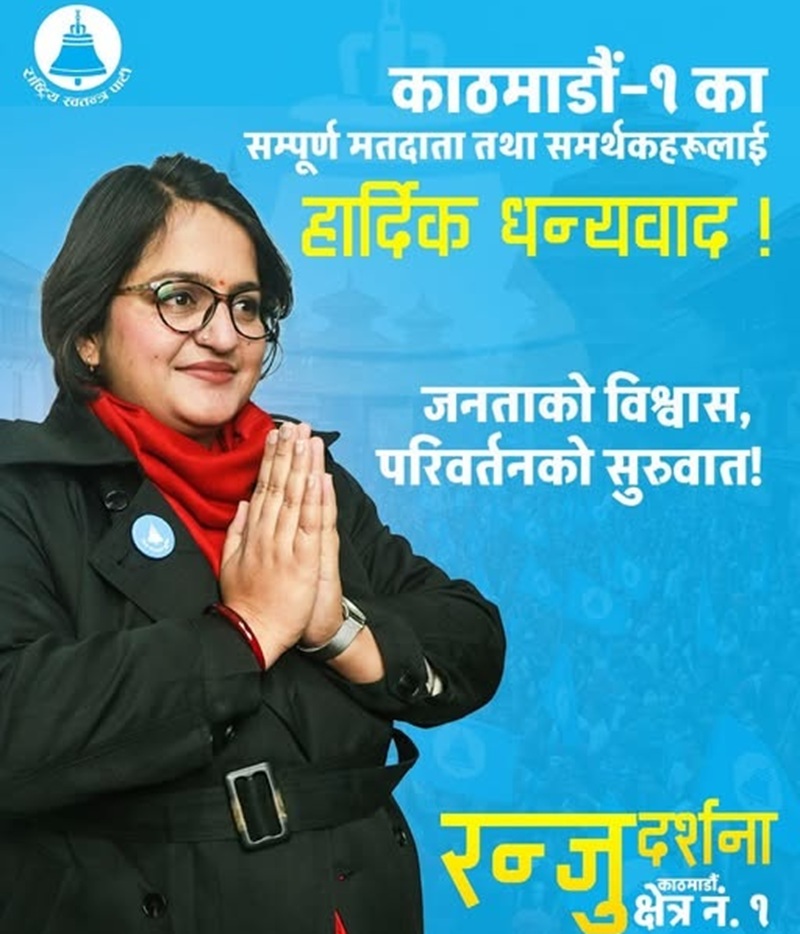

22nd May 2023, Kathmandu

In general, inflation means a substantial and rapid rise in general price level, which causes a decline in the purchasing power of money .

Inflation occurs when the supply of money in the economy exceeds the supply of goods and services. When there is more money available, people have more purchasing power, and they are willing to pay higher prices for goods and services. This increased demand drives up prices.

Inflation is typically measured using various price indexes, such as the Consumer Price Index (CPI) or the Producer Price Index (PPI), which track the changes in the prices of a basket of goods and services over time. The inflation rate is the percentage change in the price level over a specific period.

Inflation is a rise in prices, which can be translated as the decline of purchasing power over time. The rate at which purchasing power drops can be reflected in the average price increase of a basket of selected goods and services over some period of time. The rise in prices, which is often expressed as a percentage, means that a unit of currency effectively buys less than it did in prior periods. Inflation can be contrasted with deflation, which occurs when prices decline and purchasing power increases.

In Common view, inflation is the phenomenon of rising prices and it is a monetary phenomenon. In Keynesian view, it is the phenomenon of full employment. Inflation is the result of excess aggregate demand over the available aggregate supply and true inflation starts only after the full employment. The rise in price before the full employment is semi-inflation or reflation or bottleneck inflation.

In modern view, two types of inflation can be observed. They are demand pull inflation and cost push inflation. In demand pull inflation, inflation and falling unemployment are supposed to go together. In cost push inflation, inflation and rising unemployment occur simultaneously.

Features of inflation

- Inflation is purely a monetary phenomenon

- Inflation is a processes of rising prices not high price

- Inflation is not temporary function in price but is a sustained and appreciable increase in prices.

- In Inflation, value of money decreases but price of goods and services increase.

- Inflation Occurs due to the high quantity of money.

- Inflation means the increase in general price level, not the increase in individual prices

- True inflation starts only after full employment

- Inflation appears when aggregate demand exceeds aggregate supply

- Inflation is statistically measured in terms of percentage increase in the price index per unit of time

- Inflation may be demand pull or cost push

Causes of Inflation

Demand Pull Inflation:

Demand pull or excess demand inflation is a situation often described as “too much money chasing too few goods”. According to this theory, an excess of aggregate demand over aggregate supply will generate inflationary rise in price. This occurs when the demand for goods and services exceeds the available supply. When consumers have more money to spend, they bid up the prices of goods and services, leading to inflationary pressures.

- Increase in money supply

- Increase in private expenditure

- Increase in exports

- Repayment of old debt to the public

- Shortage of goods and services

- Increase in government expenditure

- Reduction in the rate of taxes

- Increase in no. of population

- Earning of block money

These indexes calculate the percentage change in prices over time and provide insights into the overall inflation rate. Central banks and policymakers use these measures to monitor and manage inflationary pressures in the economy.

It’s important to note that inflation can have both positive and negative impacts on an economy, and policymakers aim to maintain a stable and moderate level of inflation to support economic growth and stability.

Broadly speaking, inflation is caused by two factors due to the increase in effective demand and due to the rise in cost of production. The inflation caused by increase in demand is known as demand pull inflation. On the other hand, the inflation caused by increase in cost of production is known as cost push inflation. There are many other factors within these two reasons which are explained as;

Cost Push Inflation:

This type of inflation is driven by an increase in production costs, such as wages or raw materials. When businesses face higher costs, they pass them on to consumers in the form of higher prices, resulting in inflation.

Inflation that occurs due to the pressure of cost is called cost push inflation. It is also known as supply side inflation or make up inflation received in 1950 and become principle cause of inflation in 1970s. according to this theory, the prices instead of begging pulled by excess demand are pushed up as a result of rise in the cost of production.

It attempts to explain the rise in price when the economy is at below full employment cost push inflation is caused by wage push and profit push to prices.

- Wage push

The basic cause of cost-push inflation is the rise in money wages more rapidly than the productivity of labor. In modern times, trade union are very powerful. They press employers to grant higher wages in excess of increase in productivity of labor. This increases the cost of production and in turn, prices rise.

- Profit push

In monopoly and even in oligopoly market, they able to raise the price of their products due to their hold in market, the profit margin rises and inflation occurs due to the profit push.

- Raw material push

The rise in price of commodities due to the rise in prices of domestically produced or imported raw materials.

Built-in Inflation:

This refers to inflation expectations becoming ingrained in the economy. For example, if workers expect high inflation, they may demand higher wages, leading to increased costs for businesses and, ultimately, higher prices.

Measurement of Inflation

Inflation is typically measured using price indexes, which track the changes in the prices of a representative basket of goods and services. The most common indexes used for measuring inflation include:

- Consumer Price Index (CPI): It measures the average change in prices of goods and services typically consumed by households.

- Producer Price Index (PPI): It measures the average change in prices received by producers for their goods and services.

- GDP Deflator: It measures the change in prices of all goods and services included in the Gross Domestic Product (GDP) of an economy.

Inflation is a concept that refers to the sustained increase in the general price level of goods and services in an economy over time. It is measured by tracking the changes in prices using various price indexes, such as the Consumer Price Index (CPI) or the Producer Price Index (PPI).

Central banks and governments often aim to maintain a stable and moderate level of inflation through monetary policy and fiscal measures. They may use tools such as interest rate adjustments, open market operations, and government spending to manage inflation and promote economic stability.