How Banks Can Use Viber to Reach Out to Young Generation?

28th May 2023, Kathmandu

Over the next decade, Gen Zs and Millennials will become banks’ most important customer groups as nearly $70 trillion in wealth passes to them from their parents.

What does it mean for the banking industry? First of all, it has to digitize fast. New generations are mobile-first: they want to have quick, convenient, and easy-to-navigate access to services.

With nearly half of Gen Z and millennials wanting to find necessary information online, their expectations of banking differ from their parents.

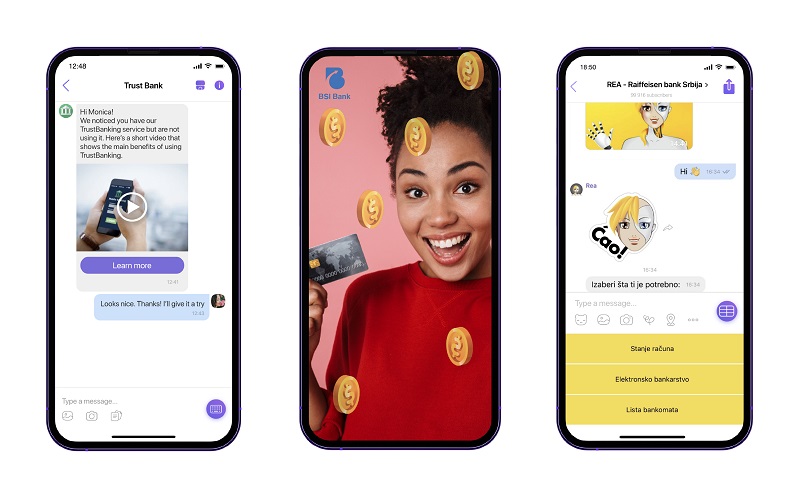

By using messaging apps, banks can communicate familiarly and effectively that matches the preferences of young people. Chat apps can help create stronger connections with this customer segment, and ensure your services remain relevant and appealing to a digitally adept generation.

Let’s break down the benefits of this channel and what young people expect from bank communication.

Privacy is paramount

Young people are increasingly concerned about privacy and control over their personal information. What banks should be looking for is a messaging platform that conducts rigorous verification for official accounts, ensures reliable encryption of brand-user chats, doesn’t sell customers’ information, and allows only secure HTTPS connections to its servers. For instance, at Viber, we’ve incorporated all these principles into our DNA: we adhere to all applicable data privacy laws, do not store users’ messages after delivery for security reasons, and make sure that private and brand-user communication on the app is protected. For many industries, but especially for banking, settling for anything less is simply not worth the associated risks.

Mobile devices are a top choice

Mobile devices are the primary means of communication for young people, making it essential for banks to adapt their communication strategies accordingly.

Messaging apps are mostly mobile-first platforms, which means their design is tailored for smartphones and tablets.

By leveraging them as a communication channel, banks can accommodate the mobile preferences of this demographic, ensuring that their services are easily accessible and convenient to use.

Personalized and interactive experiences are a must

This audience values customized and engaging experiences that cater to their needs and preferences. Messaging apps allow banks to create them for users by sending customized messages, sharing multimedia content, sending quizzes & polls, and asking for feedback. This way, a bank can connect with the demographic more effectively and keep them engaged with the bank’s products and services.

For example, we saw the popularity of interactive AR experiences on Viber: since its launch, users have engaged with AR lenses on the platform almost 1 Billion times. Brands also leverage this tool and create their own AR lenses to increase brand awareness, enhance marketing, and cater to the Gen Z audience.

The shift toward texting

The shift toward texting

About 75% of millennials – people born between 1981 and 1996 – prefer sending texts over making calls. As this trend continues to grow, banks should respect and adapt to this shift in communication preferences.

Calling young consumers may be perceived as intrusive and not give the required results. On the other hand, sending a message on a messaging app can be a gentle yet effective way of initiating a conversation and providing support or information without being overly intrusive.

Conclusion

Gen Z and millennials are banking online: they value privacy, prefer messaging to calling, and seek personalized experiences.

While they are becoming the most important customer segment for banks and financial institutions around the world, finding the best ways to engage them is crucial.

Messaging apps seem to offer what this audience needs: security, convenience, and interactiveness. Offering all these benefits, chat apps could just be the leap that will elevate smart banks.