How to Fill in the IPO Of Mero Shares in Nepal?

2 January 2020, Kathmandu

How to fill in the IPO? Should new investors be to follow such a process?

There is a wave of IPO broadcasting at this time. Several 17 companies are preparing to issue Five Arab Eighty-One Crore IPOs worth Rs 5,81,00,000. It was only then that Prabhu Life Insurance, Sanima General Insurance, Samaj Microfinance, Reliance Life Insurance, Mountain Resources, United and Mardi Company released IPOs.

Similarly, Chandragiri Hills Company also sold IPO to the public from Poush 24. Nepal Infrastructure Bank has been given permission to issue an IPO worth Rs 8 billion. The bank will soon open 80 million IPO applications worth Rs 8 billion.

Do you want to invest in an IPO with so many companies on the IPO line? I want to invest, but I’m worried about how to repay it. You are therefore now following this method. Stock market A new person who does not have knowledge or processes and wants to invest in stocks. We have prepared this information targeting new investors who want to fill the IPO.

Open a bank account:

If you are thinking of investing in an IPO, you must first open a bank account. Just as people open a bank account to deposit their money and withdraw it at any time, a bank account is also mandatory for filling up shares.

Open a demat account:

Much as we get an ID password by filling out a bank account form for mobile banking/internet banking. Simply go to the bank and fill in a demat account form/application, after opening the bank account to fill in the shares. A demat account is an account in which you have to deposit shares in a demat account just like you have deposited money in an IPO bank that you have deposited. In other words, a demat account is an account that houses your shares. Therefore, an IPO is also required to fill out a demat account. If the shares fall after the end of the IPO, the shares will be credited to the same demat account.

Where to open a demat account?

You can open a demat account by going to the same bank where you opened the account. Or you can open any securities broker company approved by the Nepal Securities Board. Apart from this, various banks and financial institutions, merchant banking companies have also provided this facility.

Get CRN number:

After opening a demat account, go to the bank where you have your account (the bank mentioned in the demat account) and get the CRN number. The CRN number connects your bank account and demat account. Therefore, the CRN number is very important. You need a CRN number to fill out an IPO.

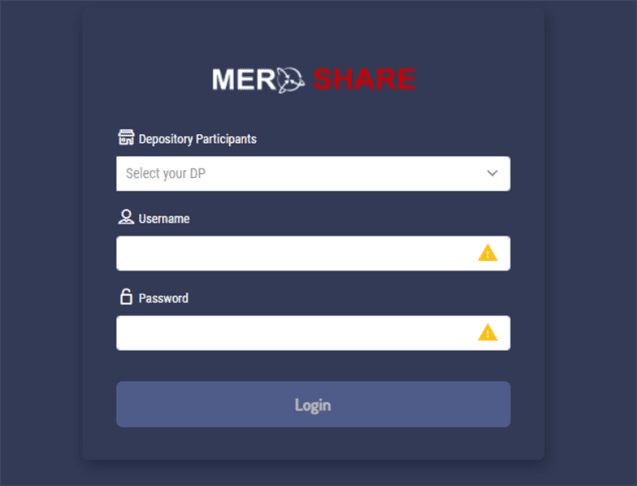

Open My Share:

My Share is an app. Just like you can do various transactions through mobile banking/internet banking, you can also fill an IPO from my shares at home. I also need shares to fill out an IPO and view the details in my demat account. CDS & Clearing Limited (CDSC) provides demat in case of an opening.

How to get my share username and password?

After applying for a Demat account and my shares in the bank where you have an account, the bank will provide you with the username and password of my shares via email. If you have taken the share username and password, you can apply for IPO from home or anywhere through the internet.

Apply from the bank?

People who have not taken my share can also apply for an IPO. But for that, you have to apply by filling the form from the branch where you have your bank account.

You can conveniently apply from home after completing the above procedure to invest in an IPO. When applying in this way, the amount equal to the share you want to apply for must be on your bank account. After filing an IPO, the balance equivalent to the value of the shares you intend to purchase will be blocked in your bank account. After the allocation of the shares, the amount equal to the shares you got shall be deducted from the bank account and the shares received shall be credited to the debit account. The outstanding balance will be returned to your bank account. There are two ways to make the most of investing in stocks.

First, if you have invested in any company, you may receive an annual dividend. So invest in stocks of the best company possible. You can also take advantage of the secondary market. You can take advantage of fluctuations in the share price in the secondary market. You can take advantage of the opportunity to sell shares at a higher price than you bought.