20th July 2023, Kathmandu

In today’s fast-paced digital age, messaging apps have become an integral part of our daily communication.

This shift in communication channels has not gone unnoticed by the financial industry – many banks and financial institutions embraced the potential of chat apps to connect with customers and deliver innovative services.

A decade ago, the thought of receiving a message from your bank containing an emoji seemed far-fetched; yet, here we are today, witnessing an incredible evolution in the way financial institutions interact with their clients.

As messaging apps gain momentum, the financial sector is finding creative ways to offer customers a more personalized, convenient, and efficient experience. From providing instant customer support to streamlining transactions, messaging apps have become invaluable tools for banks and other financial services. While these organizations venture into the world of emojis, GIFs, and engaging content, they must also walk a fine line to ensure their brand image aligns with the trust and reliability that customers have come to expect.

Let’s explore the transformation of messaging apps within the financial industry and beyond and shed light on the challenges and opportunities that lie ahead for both businesses and consumers.

Banking on Messaging Apps: Combining Engaging Content with a Trustworthy Image in Finance

Messaging apps have become important in the financial world because people find them easy and fast to use. About 58% think these apps are the quickest way to talk to businesses. They have already been adopted by many financial institutions to send account updates, provide customer service, and promote new products and services.

Text, Multimedia, and Chatbots – The Dynamic Transformation of Messaging Apps in the Financial Industry

In recent years, banks have successfully transitioned to texting as a primary means of keeping in touch with clients. Messaging offers a convenient and efficient way to communicate, catering to the preferences of today’s fast-paced world.

One of the key driving forces behind this transition is the fact that 75% of millennials prefer messaging. Recognizing this trend, banks have adapted their communication strategies to align with it and deliver a more customized experience.

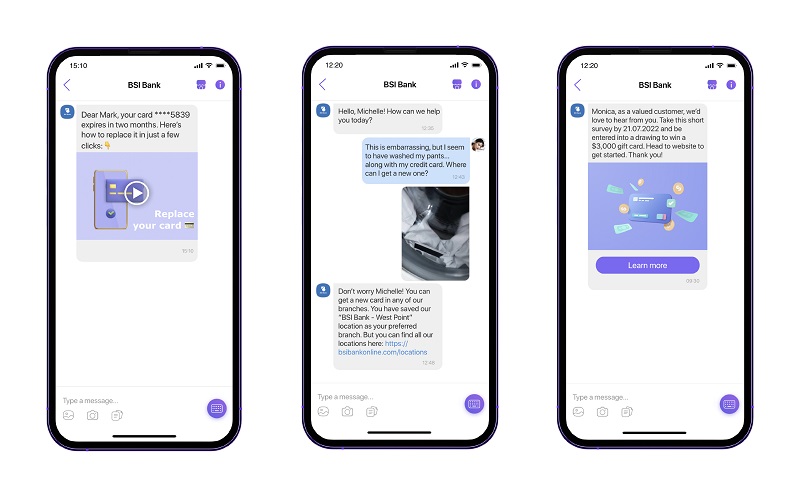

From in-person visits to messages: With the widespread adoption of chat apps like Viber, it is now possible to create an entire experience through messaging platforms, from building awareness and driving conversions to providing support and ensuring loyalty. This approach not only helps increase response and conversion rates but also offers a better experience for both the banks and their customers.

Enhancing customer communication with rich-media business messages: courtesy of Viber

Transition to multimedia content: Today’s advanced applications enable banks to use rich multimedia content to reach and communicate with people. For example, brands on Viber create branded lenses, share images, files, and videos in business messages, send stickers and carousels in chatbots, and so much more. These capabilities help to effectively build awareness, connect with clients, and maintain their interest in the banks’ products and services. Additionally, sharing engaging and informative resources, such as infographics and videos, further enhances the customer experience and provides valuable information.

Implementation of chatbots: Banks have tapped into the benefits of chatbots as they offer 24/7 assistance and are more efficient than traditional email support. Today’s customers expect personalized and timely interactions with businesses. Chatbots cater to these expectations by providing accurate information, fast response times, hassle-free support, and self-service options. With chatbots, banks can increase satisfaction, loyalty, and overall confidence in their services – while leaving live support agents to deal with more complex questions.

Embracing the Messaging Era

In today’s constantly changing world, banks and financial organizations that use messaging apps can stay ahead and become industry leaders. Chat apps make communication easy, focus on the customer, and improve trust and loyalty. Incorporating messaging apps into the financial industry’s communication strategy is no longer a luxury but a necessity to thrive in an increasingly digital world.