Global IME Capital Also Joins NPS

13th September 2022, Kathmandu

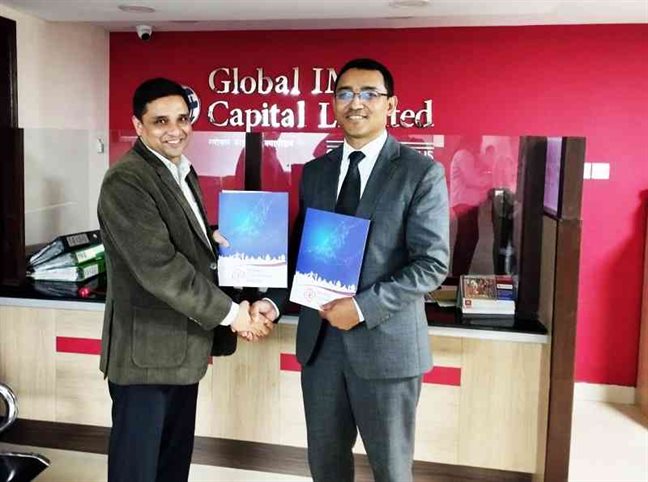

Global IME Capital Ltd. (GICL) has signed an agreement of National Payment Switch (NPS) with Nepal Clearing House Ltd. (NCHL) for automating its various payment processes, including disbursements and collections. The agreement was signed by Mr. Paras Mani Dhakal, CEO of GICL, and Mr. Neelesh Man Singh Pradhan, CEO of NCHL.

GICL is already a technical member of NCHL and has been using NCHL-IPS for the last 6 years. With this agreement entered today between GICL and NCHL, GICL will now have access to various digital instruments under NPS through National Payments Interface (NPI) for automating its payments including various disbursement and collection like dividend payouts, DP fee collection, trade payments, mutual fund related payments, etc. GICL will initially roll out Request To Pay direct debit of various collections and dividend transactions.

NPI is a consolidated interface for interconnection with multiple underlying payment systems of NCHL, which is now a part of the National Payment Switch.

It has over 59 BFIs within the network and is being used by 73 plus non-bank institutions including PSPs/PSOs, insurance companies, remittances, merchant banks, Government, Semi-Govt institutions, large corporates, etc.

Global IME Capital (GICL) has been licensed for providing merchant banking services since 2008, as a subsidiary of Global IME Bank Limited.

It offers services including issue management, share registrar, underwriting, portfolio management, assets management, depository participation, and corporate advisory. It has been improving its services and customer experience by adopting digital channels and this engagement of GICL is expected to further improve its service delivery.

For more information, visit www.nchl.com.np.