How to Activate Mobile Banking in Nepal: Step-by-Step Guide!

May 29, 2020, Kathmandu

We’re actually in an age of digital wonderland where everything we know is transitioning into digital platforms. From online shopping, online registrations, and now to online banking. Online banking skyrocketed so fast that now mobile banking in Nepal is becoming so popular and common.

Steps to activate mobile banking in Nepal: Quick Summary

| Step 1: | Download the Mobile Banking App & Install in your device. |

| Step 2: | Fill your a/c number, ATM card number & phone number. |

| Step 3: | Submit your information & wait for verification. |

| Step 4: | Use the code after verification to activate mobile banking. |

Today, we’ll share with you some easy steps to activate mobile banking in Nepal.

Easy Steps to Activate Mobile Banking in Nepal

Firstly, download the mobile banking app on your Android or iOS device. You’ll have to download the mobile banking app of the bank you have an active account of.

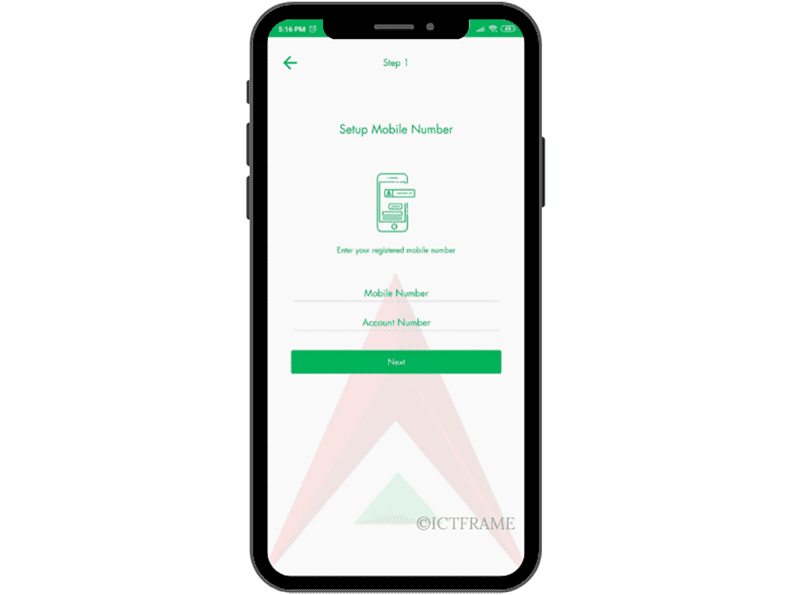

After your download is complete, open the app and click on Registration. While registering, the software will ask for your bank account number, ATM Card Number, and Phone Number.

Image: Nabil Bank Mobile Banking Registration

After you fill up all the information, you can tap on submit and your mobile banking request will reach the concerned bank.

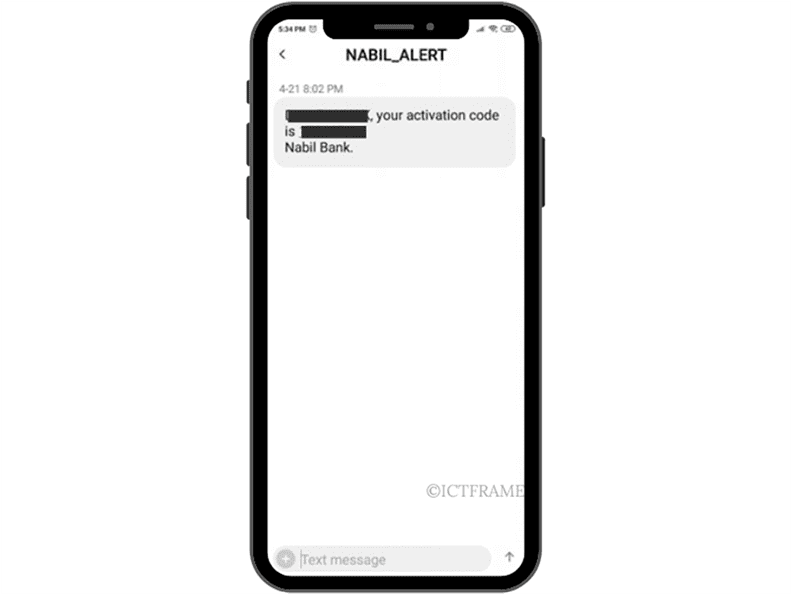

At this moment, the bank will verify your account number and mobile number. Similarly, the bank will send you an OTP activation code as an SMS on your registered phone number.

Now, you can use that code and enter it into your mobile banking app. Subsequently, enter a login password and activate your mobile banking services!

You have successfully activated your mobile banking services.

Easy, right?

Now you can easily practice mobile banking in Nepal.

Related article: Create a Bank Account Online: Step by Step Guide

We are sure you’re wondering how this mobile banking is useful to me. We’ll tell you how it’s helpful! Read below to unlock fascinating features of mobile banking:

5 Ways Mobile Banking Makes Life Easy!

View Account Balances

Now you don’t need to go to your bank to stand in a long line and ask the lady behind the desk for your account statement just to check your balance. All you need to do is log in to your account and you can easily check your balances!

Instant Updates of transactions

Do you sometimes wonder if someone tells you they will transfer money to your account and you’re wondering if they even have? Well, mobile banking gives you an instant notification. This means, if there is any transaction happening in your account, you will get notified at the same time.

Transfer Funds to Banks

Do you remember going to a bank to take out cash and then going to another bank to make deposits? Say goodbye to those old methods of transferring funds. Just take out your phone, log in to your account and hit transfer to whichever bank’s account you want to transfer.

Pay Utility Bills

Not just that you no longer need to go to the bank, but you also don’t need to stand in line for making payment for your internet, drinking water, electricity bills, or even school fee payments. You can do all that just sitting on your couch watching your favorite movie.

Load Digital Wallets

eSewa, Khalti, and IME Pay are some digital wallets that you can easily sync with your mobile banking. With the addition of a digital wallet to your mobile banking, you can make cashless payments as well. For example, making payments at your favorite coffee shop, or booking a ticket for that movie night.

With all this exciting information we have for you, you must still be wondering what is the difference between internet banking and mobile banking in Nepal.

You may also like: Open your NMB Bank account through Viber

Let’s get you covered with that as well!

Internet Banking vs. Mobile Banking

- Internet Banking means carrying out your banking transactions from the internet instead of physically visiting the bank. The bank will provide you with a separate profile and a separate password. This will allow you to log in to your account on the bank’s official website.

On the other hand, mobile banking is pretty similar to that of internet banking. You will log in to a mobile app instead of the website.

- You can easily access your mobile banking with your mobile devices like cell phones or tablets.

However, you need a laptop or a computer, and an Internet connection to access internet banking.

- In Mobile Banking, you can transfer funds with IMPS (Immediate Payment Service), NEFT (National Electronic Funds Transfer System), or through RTGS (Real Time Gross Settlement).

On the contrary, you can transfer funds in Internet Banking through NEFT or RTGS.

- Mobile Banking allows quick services but you have limited access to your account. Meanwhile, all sorts of services are possible with internet banking.

Therefore, to conclude, you can use either internet banking or mobile banking as per your wish. You can easily use mobile banking to make everyday transactions. Companies, on the other hand, have complex and comprehensive transactions and hence prefer to use internet banking.

With that said, we hope your doubts are cleared with mobile banking in Nepal, the activation procedure, the benefits of mobile banking, and the differences against internet banking.

Also read: Future of Online Banking in Nepal