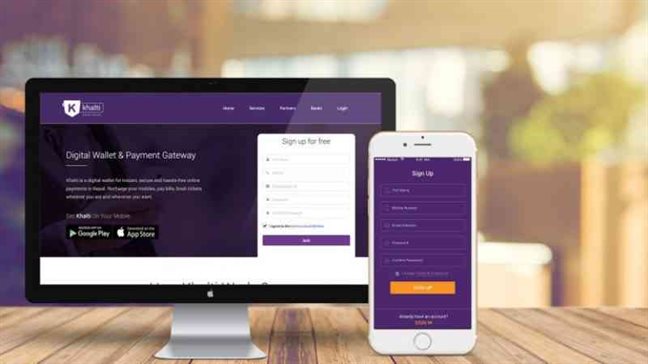

How To Create Khalti Account And Make Digital Payments In Nepal ?

Digital Payment in Nepal

During the last one decade, Nepal witnessed an emergence of e-commerce and digital payments. Many online shopping sites started, and so did the homegrown digital wallets. Khalti is one of the fastest growing and most preferred digital portfolio and payment gateway in Nepal. Using Khalti, you can very conveniently recharge your mobile, pay internet bills, electricity and water bills from your smartphone with a click of a few buttons. You can also buy movie tickets, airline tickets, and hotel rooms easily from your phone. What’s more? Khalti provides highest cashbacks in the industry. Do you also want to use Khalti for all your digital payments? In this article, we share with you the procedure on how to create Khalti account and make digital payments in Nepal.

Seven easy steps to create a Khalti account:

- Visit Khalti.com or open Khalti app on your mobile phone

- Enter your Name, mobile number, email address and a password on the sign-up a form at the top-right corner of the page

- Click on ‘Join’

- You will get a verification code on the mobile number you entered

- Enter the verification code

- Once you enter the verification code, click on ‘Verify.’

- Your account will be created successfully

However, you need to load money into your Khalti account to make online payments.

Eight ways to load fund in Khalti:

- Mobile Banking

- E-Banking/internet banking

- Debit/Credit/International Cards

- Kiosk Machines

- Khalti Transfer (Send/Request)

- Khalti Pasal (Cash Agents)

- Cash Deposit Vouchers (available in banks)

- connect IPS

Ten key features of Khalti:

- Load money efficiently using internet banking, mobile banking, cards, Khalti Pasal, connect IPS

- Recharge your mobile, and pay electricity and khanepani bills,

- Pay DTH and internet bills

- Pay at e-commerce sites

- Pay at retail stores using ‘Scan & Pay’ within a couple of taps

- Book movie tickets, event tickets, flight tickets, and hotels rooms

- Top-up Tootle balance

- Ask money from your friends

- Get cash back and earn Khalti Points on every transaction

- Pay offline without internet connection

Recently, Khalti launched the wallet to the bank money transfer facility. Now, its users can digitize cash, remit it to their family and friends, and withdraw it at their convenience.

With these features, Khalti is trying to build a digital payment ecosystem that makes it exceptionally easy for customers to make payments and for merchants to accept payments. Khalti envisions to make Nepal a digital and cashless economy.

The emerging trend of cashless payments in Nepal

Cash’s reign as the primary payment method has been on the downslide for a while, globally. Nepali businesses too are moving away from cash payments. Technorio, a Nepali tech-startup recently announced that it would be accepting digital payments only. Furthermore, the rise in the use of digital wallets is changing the payment landscape for online shopping companies in Nepal. It shows online payment service companies like Khalti are the future of transactions in Nepal.

Haven’t you tried using digital payments yet? Five reasons to use digital payments:

- Convenience: Pay from anywhere in the world where you have Internet access.

- Saves time: No need to leave your home, office, or whatever you are doing to make a journey to hand cash over to someone. It also means no need to stand in a queue or wait for someone to get change for you either.

- Track your spending: Use your records for budgeting to get control of your spending. It’s difficult to go back over a month to track from memory where your cash has gone.

- Reduced theft risk: It’s simple to block a digital wallet that has been compromised whereas it is almost impossible to retrieve physical cash that has been stolen from you.

- Discounts, rewards, and prizes: You can earn points, obtain discounts or even get freebies when you use your digital wallet for payments.

Let’s use digital payments and make Nepal a digital and cashless economy.