Internet Banking/Online Banking in Nepal: The Evolution and Future Prospect

11th May 2020, Kathmandu

We don’t need to be reminded that we are living in the technology era. With the advancement in technology, one of the latest technologies on the rise in electronic banking (or eBanking). In this article, we are going to look at the evolution of the increasing trend and popularity of online banking in Nepal.

Internet banking is actually a channel of e-Banking that allows customers to perform financial transactions online through their devices. There are no restrictions in time and convenience but yes, some banks have a transaction limit. Thus, the shift to online channels has changed the way we interact with banks.

Introduction to Online Banking/eBanking

It is quite clear from the name itself. Online banking or Internet Banking is the use of an electronic payment system to perform transactions through the financial institution’s website or portal. It is one of the modes of eBanking that provides virtual banking facilities.

Nowadays, mobile banking is also gaining popularity but it shouldn’t be mistaken with internet banking. Sure, you use your smartphone’s application or internet but the two have significant differences. Both are the modes of eBanking.

Nevertheless, online banking facilities allow you to use the internet in order to pay your utility bills and transfer funds. Similarly, you can monitor your account balance and transactions from anywhere and anytime using your mobile or PC. Great thing is that its use is less time consuming and highly secure.

Online Banking in Nepal: How it Started?

With the establishment of Nepal Bank Limited in 1937, the banking sector had to wait for 65 years before adopting internet banking service in Nepal. The first online banking service came around 2002 but still, it hasn’t made its mark among some customers.

Grab on to your seatbelts! Because we are going to take a quick trip to the history of eBanking in Nepal.

In 1990, the banking sector in Nepal saw the introduction to the first Credit Cards. The establishment of the first ISP in Nepal (Mercantile Office Systems) was back in 1994. Similarly, the first ATM was launched in 1995 by Himalayan Bank Limited.

The evolution of private sector bank (Kumari Bank) in 2001 led to the internet banking evolution as well. Internet Banking was first introduced in Nepal by Kumari Bank in 2002. Likewise, Kumari Bank was responsible to launch SMS Banking (Mobile Banking) back in 2004.

Present Scenario of Online Banking in Nepal

Internet banking was introduced relatively late in Nepal. There are still some people struggling with the use of the internet let alone the use of online banking. However, the recent stats show much improvement in the digital literacy of people in Nepal.

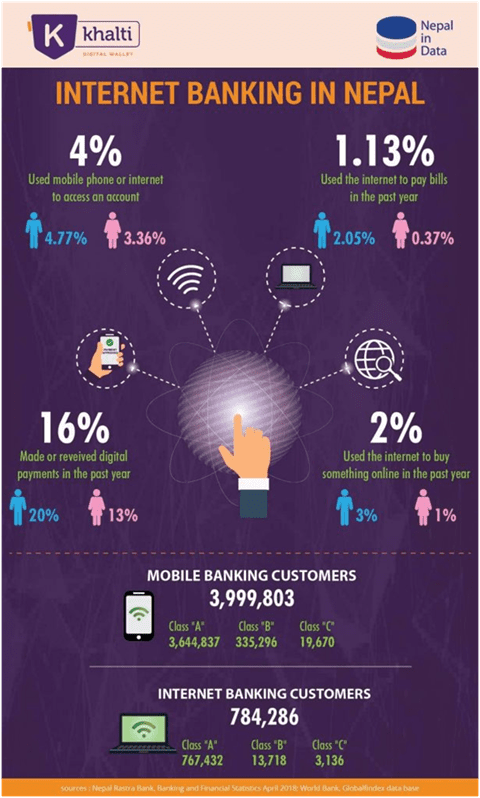

Reports of Nepal Rastra Bank on online banking in Nepal nearly 4 million mobile banking customers and 0.78 million internet banking customers.

Online Banking Statistics in Nepal in 2018 (Khalti Digital Wallet)

You can clearly see that only 1.13% of the adult population used internet banking to pay bills online. However, 16% of people made or received digital payments which point towards a potential digital shift in financial transactions.

You May Also Like: How Can Telco and ICT Sectors Support the Digital Movement of the Government

Future Prospects of Online Banking in Nepal

The advancement in the business and finance sector has brought about remarkable changes in the banking sectors, especially in online banking. The user acceptance towards online banking in Nepal has been increasing when we look at the stats. However, due to the COVID-19 pandemic, we could be soon witnessing a revolution in online banking facilities.

The pandemic and lockdown in Nepal have generated an opportunity for technology to take the lead. People are slowly but surely realizing the importance of the internet and its facilities. Online banking is no different.

Yes, there are challenges in the internet banking domain. Factors like the digital divide and digital poverty affect the usage of such services in the remote areas of Nepal. However, this exactly is the opportunity to develop the ICT infrastructure so that more people can gain access to internet banking/e-banking services.

Also Read: Digital Payment: Challenges and Possibilities in Nepal

The government is moving forward with the Digital Nepal Framework. It is planning to implement the electronic payment system in the payment of its expenditure and revenue collection. With revenue payment and tax collection shifts to online platforms, less cash or cashless ecosystem won’t be difficult to achieve.

Important Security Tips to Use Online Banking Safely

- Access your bank’s website/web portal/application only by typing the URL in the address bar of your browser

- Clicking on any links from email or SMS to access the bank’s site may lead to a breach of your personal information.

- No banks will send you an SMS/email or call you over the phone to provide your personal information or OTP. So, make sure to avoid such scams.

- To improve your security, update your operating system, mobile application, and use the latest version of your browser.

- Also, make sure to scan your computer regularly with antivirus and ensure that the firewall is enabled.

- If possible, change your Internet Banking password at a regular interval.

- Monitor your transactions and activity log.

- Avoid accessing your online banking services from shared PCs, cyber cafes, or untrusted devices.