Market Structure

Market structure is used in many context in which market is the place where goods and services are bought and sold although it doesn’t have any actual place.

For instance, foreign currencies are bought and sold through international telephone calls and telex transfers between bank accounts. The buyer and seller must be in contact and in medium societies the exchange is via the medium of money. The traders involved are willing participating in the exchange and require information on the practice of goods and services involved.

Governments may influence markets generally through legal constraints but they don’t decide how much is traded. This is usually determined by price which acts as a signal and as incentive.

Forms of market structure

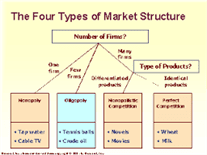

The purpose of this section is briefly to describe the main characteristics and assumption which define each form of market. There are two extremely and large theoretical forms of market via perfect competition and monopoly which are polar opposite. Under the broader heading of imperfect competition, there are three other structure which are more grounding in reality. These are monopolistic competition, oligopoly and duopoly. All these markets are defined by the terms and number of supplier in the market.

Discussing Market structure

Structure

This is defined in terms of seller concentration, the number of firms, type of products and the existence or otherwise the barriers to entry.

Conduct; price behaviour

How much freedom does the firm have to set any price it5 wants.. is a firm price taker or maker?

Efficiency

It makes more sense to concentrate on considering technical and allocative efficiency in markets in a micro analysis. There are three general meaning such as Technical efficiency, Allocative efficiency, x-inefficiency.

Profit

Is the firm making just enough profit to justify staying in the industry rather than moving elsewhere or it can make more than this.

There are many market in all type of modern economy ranging from large scale and official.