Make Payments Directly From Banks Through CellPay

15th December 2020, Kathmandu

It is the 21st Century and currently, in the world, most of the services can be done online staying at home. Paying the utility bills, making top-up, booking flights and many more things can be done easily from just your fingertip.

Every one of us may have heard about some of popular Nepal’s E-Payment services like E-Sewa, IMEPay. All most all of these services are wallet based. But CellPay is a non-wallet-based system where you can make the bank-to-bank transfer, Merchant payments, make your payments, and Top-up as well.

This app is powered by Cellcom Private Limited and is licensed by Nepal Rastra Bank. Unlike other E-payment services that operate on a wallet, it is the first non-wallet-based system, it operates from websites and mobile applications. So, if you don’t have a card or wallet it’s no problem as all your transactions can be done from your linked bank account.

Features of CellPay

1.Multiple Banks

With CellPay you can link multiple bank account to your platform. It currently has a partnership with 17 Bank. They are:

- Century Bank

- Citizens Bank

- Mega Bank

- Nepal Bangladesh Bank

- Civil Bank Ltd

- Everest Bank

- NCC Bank

- Kumari Bank Limited

- Nepal Investment Bank Limited

- Global IME Bank

- Himalayan Bank Ltd

- NIC Asia

- Prime Bank Ltd

- KamanaSewaBikas Bank Ltd

- MuktinathBikas Bank

- ICFC Bank

- Laxmi Bank

- Instant Transfer

Customers using this app can transfer funds to others in real-time and also get notifications instantly.

- Scan and Pay Using QR Code

The customers can scan the individual or merchants’ QR Code and make payment.

- Self-Transfer

With Cell pay, customers are able to transfer funds from their own bank account to another bank account.

- Transfer Funds with Mobile Number

Customers can also send funds to the receiver’s mobile number. After that receiver’s bank account will be credited. There is no worry about funds being mismatch as if it gets sent to a non-registered number the transaction will fail.

- Language Support

CellPay has two language support: Nepali and English.

How to use CellPay?

It is available on both Android and iOS. It’s easy to use it as it is user friendly. Below are the steps on how to begin with this app.

- Download and install the CellPay app.

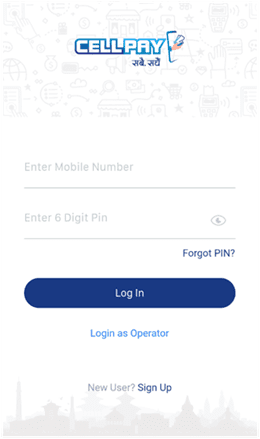

- The registered users can directly login into the system while the unregistered user should tap on ‘sign in’ to get them registered.

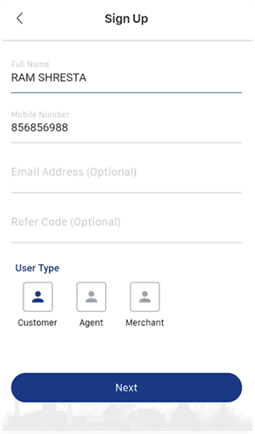

3. Fill in your details and choose your user type.

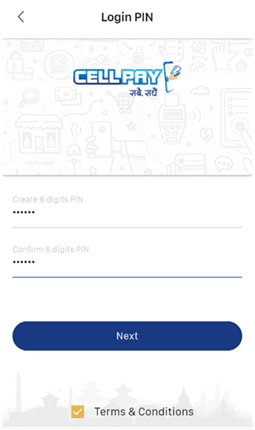

4. Then create your six-digit pin. Also, do not forget to mark the terms and conditions which is at the bottom of the screen.

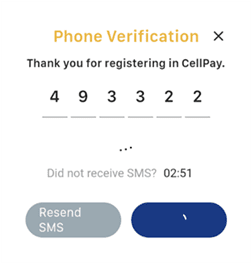

5. The app will send an OTP code to your registered number. Enter the code and verify your account.

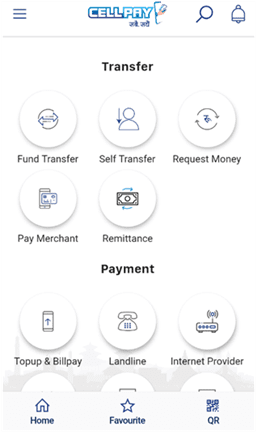

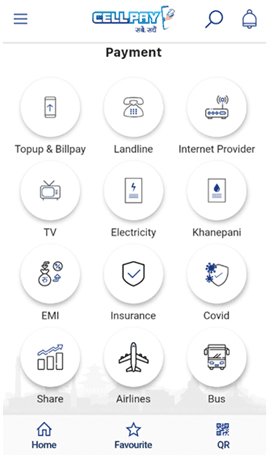

6. After verifying your account, you will be successfully logged into the app. On the home screen, you can see transfer and payment options.

You can see all the available transfer and payment options on the home screen. To link your bank account, you need to update the KYC. After your KYC is activated which will take some time, you will be able to link your bank account. Then, you are all set to transfer or pay using this app.

Offers

CellPay is promoting its app by providing some eye-catching offers.

- Once a user links their bank account to the app, they will get a free top-up of Rs.100

- A 10% loyalty bonus is provided on the first payment transaction.

- The users can also get a 3% discount on every top-up and utility payment.

This app provides its users with hassle-free features to use with all the above-mentioned offers. So, what are you waiting for? Download the app and enjoy the features provided by CellPay.