How to Get QR Code of Everest Bank?

19th November 2020, Kathmandu

Cellphone, Wallets, keys, cash, cards, face mask, handheld sanitizers… the things to remember to carry as we walk out the door has only kept on increasing. However, with the technological advancements, there is a foreseeable future where these things will increase. In fact, many of the aforementioned things are slowly transitioning into our cellphones. You can unlock certain cars and houses without keys with the use of your phone. With promising COVID vaccine news, hopefully masks and sanitizers will go back to being a professional tool. Cash too is almost unnecessary in most western countries now with card payments and NFC being rampant. Now, with the steady advancement and implementation of QR code payment systems, even cards might become unnecessary, removing the weight of a wallet from your pants!

A QR code payment system uses a QR code linked to a bank account for payment. A QR code is a two-dimensional code that is made up of black and white squares, which is read by smartphone cameras, Point of Sale (POS) terminals, and other devices. It is an alternative channel to do electronic funds transfer at point of sale. Banks and non-banking entities around the world are testing this system to bring an easier payment service to their customers. QR code payment system is a modern way to avoid the hassle that comes with Cash or Card payment and the infrastructure associated with such payment methods.

Everest Bank has rolled out a system that allows QR code payment from over 16 million customers from more than 50 banks that allow digital payment directly from their bank account.

Through this new system, a customer simply has to scan QR code of the merchant or business by mobile and pay the bill amount instantly. The payment will then be directly transferred to the account associated with the QR code.

With QR code, businesses and merchants are also able to receive digital payments from their customers. This payment is credited instantly and directly transferred to the linked bank account, making the process much quicker than traditional methods. The merchants can also check payment details and statements online at their convenience.

How to Get the QR code of Everest Bank?

Step 1: The business entity must open an account with Everest bank

(No minimum balance to open an account for QRC merchant.)

Step 2: Submit the PAN and business registration document to the bank

Step 3: Fill up a Merchant Registration Form provided at the bank. You can also

find this form on Everest Bank’s official website.

Step 4: Sign an agreement with the bank.

Process of Payment through QR code

As a customer, when you see a business which offers payment through the QR code system, you can follow the following steps to make the payment:

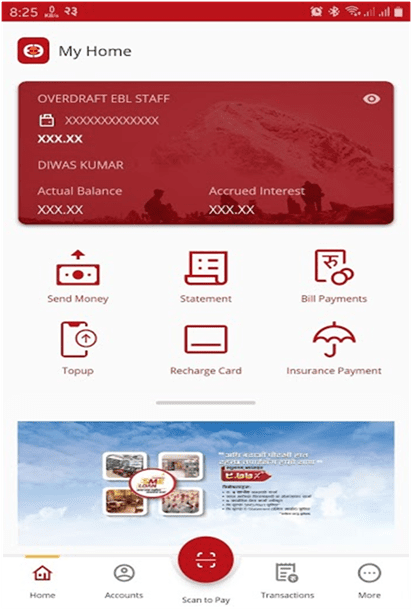

Step 1: Login to EBL Touch 24 and click on the scan to pay option at the bottom center.

Step 2: Scan the QR code of the merchant. Both digital and printed QR code works.

Step 3: Type the bill amount then press ‘Submit’.

Step 4: Click ‘Confirm’ then enter the PIN when prompted. You will receive a notification of payment status.