Startup Business Exempted From Income Tax For Five Years

30th May 2021, Kathmandu

A startup refers to a company in the first stages of operations founded by one or more entrepreneurs who want to develop a product or service for which they believe there is demand. They look for capital from several sources, such as venture capital, because they generally start with high costs and limited revenue.

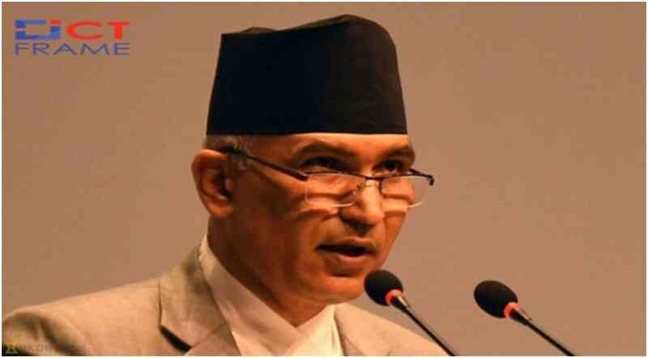

The government has adopted a policy of income tax exemption for startup business promotion. The budget announcement of the annual year 2078 was done on Jestha 15 by Finance Minister Bishnu Poudel and made the announcement.

To revive the economy affected by the Covid epidemic, the government has announced a 100 percent rebate on income tax for startups for up to five years from the start of business.

The government has decided to provide a one percent interest rate soft loan to startup businesses to motivate the youth in entrepreneurship.

Presenting the budget for the coming fiscal year, Finance Minister Bishnu Poudel has announced loans of up to Rs 2.5 million at one percent interest to startups (new ventures) for seed capital.

In addition, the budget has mentioned that a one-stop system will be implemented to facilitate the establishment and operation of such startups.

Similarly, the government will set up a challenge fund of Rs 1 billion to help new entrepreneurs financially, said Minister Poudel through the budget.