14th May 2020, Kathmandu

Viber banking enables customers to get more information about bank services and their bank accounts. Customers can get all the information through their smartphones, laptop, or desktop. But, there’s more to Viber Banking in Nepal which we will discuss in this article.

Viber Banking is a product of F1Soft International Pvt. Ltd, a leading FinTech company in Nepal. Global IME Bank started the Viber banking solution for the first time in Nepal followed by Nabil Bank. Both the banks introduced the facility in November 2017 which means most of you should be familiar with the service by now.

If not, then we will also discuss the benefits and features of Viber banking and how it can improve your interaction with your bank.

Also Read: Internet Banking/Online Banking in Nepal: The Evolution and Future Prospect

What is Viber Banking?

As I mentioned earlier, Viber Banking in Nepal has been around since late-2017. It is a digital solution that allows customers of the bank to enjoy various services improving the interaction with the bank directly through Viber. Viber Banking is a Fintech solution enabling banks and financial institutions to bridge the gap of interaction between banks and customers.

This technology enables banks to enter the era of instant messaging through a cross-platform instant messaging and VOIP application that Viber is. With this service, customers can gain easy access to the bank’s facilities in a matter of seconds. The chatbot integrated with the service understands and processes user requests instantly and securely.

How to Get Started with Viber Banking in Nepal?

It’s simple! All you have to do is subscribe to your bank’s Public Chat. It is worth mentioning that Viber discontinued Public Accounts since August 2019 and introduced Communities.

Viber announced, “From 1st August 2019, we will be ending support for Public Chats. Viber will no longer provide updates to Public Chats, and access to them will be limited for followers.”

This means you can no longer search for public accounts on Viber. Thus, this update of Viber has made the concept of Viber banking rather vague. However, you can search for a bank’s community from the search option on Viber, which is more interactive.

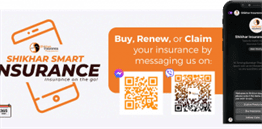

Although, it still doesn’t mean that Viber banking itself has been discontinued. You can subscribe to the service by scanning a QR code or following a link that you can easily get from your bank’s website. Just head on to the Viber banking section on the bank’s website and see if your bank supports this service.

You May Also Like: Viber Community MoHP Nepal COVID-19 And COVID-19 Awareness Nepal

Some may find this process a bit hectic but who knew Viber would make Public Accounts go obsolete.

Once you’ve subscribed to your Bank in Viber, you will have to start a one-on-one conversation in the chat by sending a ‘Hi’ or ‘Hello’. You will then receive a response promptly and the interactive menus will become available. Then, you can tap the corresponding menu buttons at the bottom to use Viber Banking.

Registering for Viber Banking Service

Here’s how to register your account with Viber Banking:

- Tap the “Registration” button to send the registration request to the bank.

- You need to enter your registered mobile number in BankSmart and send it when you receive a response.

- Then, select your preferred option to receive token like SMS or Email or, both.

- Send your 6-digit token after you receive it.

- The bank will send you a message confirming your registration.

Image: Nabil Bank (left) and NIC Asia (Right) Viber Banking Home Menu

Key Features of Viber Banking

Several banks and financial institutions are still using Viber banking. But, what does it actually provide to the customers to improve their interaction with the bank?

Basically, it merges the features of internet banking/mobile banking and website into Viber. Obviously, you can’t perform transactions with Viber Banking, yet. But, you can get all the information about any updates from the bank including your account information.

Also Read: F1Soft Post Lockdown Plans

Some of its Key Features are:

- Displays the “About Us” information of the bank.

- Subscribers get notified with the latest notices and updates published by the bank.

- Lists the location of branches and ATMs of the bank.

- Displays banking hours and its updates.

- Inquiry about the bank’s products and services.

- It allows users to check the Forex rates.

- Users can get access to FAQ easily.

- Enables users to provide feedback and comments directly to the bank through Viber.

- Gives current interest rates for various types of accounts and loans.

- Provides the link for online account opening.

Additional Key Features for Registered Users:

- Registered users can access their account information like Account Holder’s name, account number, mobile number, and email address.

- Account-holders can also display their account balance, available balance, and accrued interest.

- Displays the last 5 transactions of the account holder.

- Users can inquire about their credit card information.

- Displays EMI account, due date, outstanding interest, and loan amount.

- Displays Fixed Deposit amount, tenure, maturity date, and interest rate.

Final Say

Viber banking certainly comes in handy for a quick information check. Although, the facility doesn’t do much for registered users that mobile banking can’t. Quick access to bank information, interest rates, and notices among other things are quite helpful for the customers.

It limits the need to access the bank’s website for sure. If you don’t have mobile banking or internet banking services to monitor your account transaction or information, then Viber banking comes in handy.

Again, with limited support from Viber for Public Accounts, the subscribing process has become quite inconvenient. Personally, Viber Banking has helped me monitor my account balance and other information in the past.

Do you think Viber Banking in Nepal is a worthy interactive solution? Have you been using the service, if yes, how often?

Let us know!