Everest Bank Upgrades Mobile Banking with F1Soft | F1Soft Post Lockdown Plans

May 8th, 2020, Kathmandu

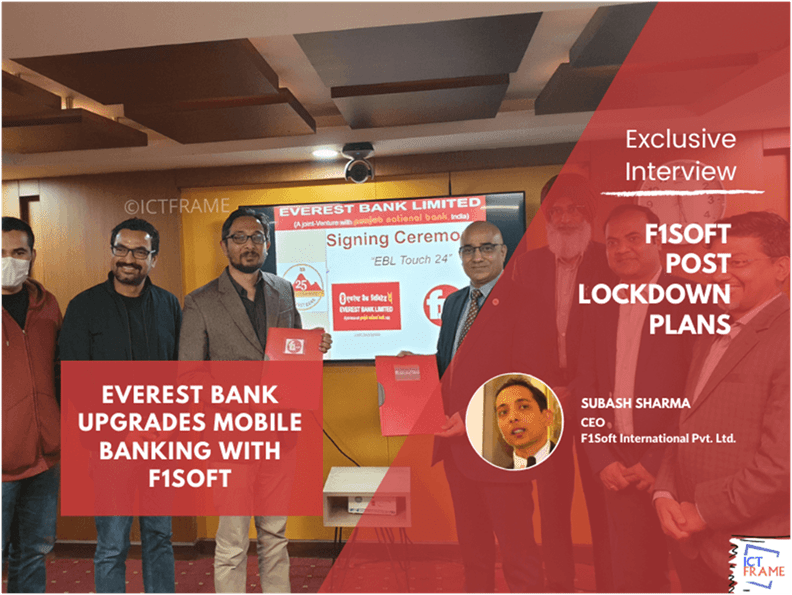

Everest Bank Ltd upgrades its Mobile Banking Application with Nepal’s FinTech Giant, F1Soft.

The agreement was signed between the CEO of the bank Mr. Gajendra Kumar Negi and F1Soft International CEO Mr. Subash Sharma. There is a major upgrade in the bank’s mobile app ‘EBL Touch 24’ with brand new features for its customers to experience.

Everest Bank previously had its mobile banking app, which is now upgraded to new and fresh user experience. With this app, customers can now easily transfer money to more than 50 bank accounts. Payment of Utility Bills, Internet, and TV payments are now accessible. Furthermore, customers can purchase movie tickets and airplane tickets online and make payments via QR scanner to more than one lakh merchants.

The software company also signed into an agreement with Century Bank Ltd for its Mobile Banking Application.

As a outcome, We thought it would be great if we could get in talks with the CEO of F1Soft himself to know more about their plans regarding the future.

Here’s what Mr. Subash Sharma has to say.

Q. What is F1Soft International doing during this lockdown period?

- Like many other companies, we are also working from home. Surprisingly, our technical productivity has increased during this time. I think it’s because of the comfort and peace of the home environment, the results and efficiency have increased.

Q. Are there any issues you are facing with the daily operations?

- Yes, certainly. None of us were prepared for such a long economic downturn along with health threats caused by the COVID-19. Proper communication and coordination are major issues at this moment. Our work requires us to stay in connection with our clients and networks. But everyone is trying to adjust and settle in the new working environment so it’s a challenge to solve issues that require prompt action.

Q. As yourself being in a B2B Industry, what suggestions do you have for businesses involved in this field during this pandemic?

- I think it’s more about being aware and mindful of the fact that you are not alone in this crisis. None of us anticipated such a downturn and none of us were ready at all. To understand that it’s not just you who is having a difficult time, but the whole country is. The whole world is.

We have to consider ourselves like one big community and help each other out. Do some small gestures for your customers or clients. It will help them a lot. You will receive small help as well. If one industry collapses, other industries will be affected as well.

Right now, we are supporting companies that deal with EMI or Insurance with collaborations of eSewa and Fonepay.

Q. What plans do you have after the lockdown ends?

- To be honest, we don’t have major plans yet. We haven’t thought about it. The Nepal lockdown seems to be extending again. From days to months, to even a year, the future right now is very unpredictable. We are more focused on providing our level best services during this crisis.

It is very necessary that we also need to care and think about our team. We need to make wise and smart management decisions for better sustainability and retention of resources. Mostly it’s a battle of survival right now. Like they famously say in Cricket, ‘One ball at a time’ here in the business world, we say ‘one day at a time.’

The company is established as a pioneer in introducing mobile banking and mobile financial services in Nepal having served more than 90% of banks and financial institutions in Nepal.

Related

Growth of Digital Payment Industry in Nepal – Digital Nepal