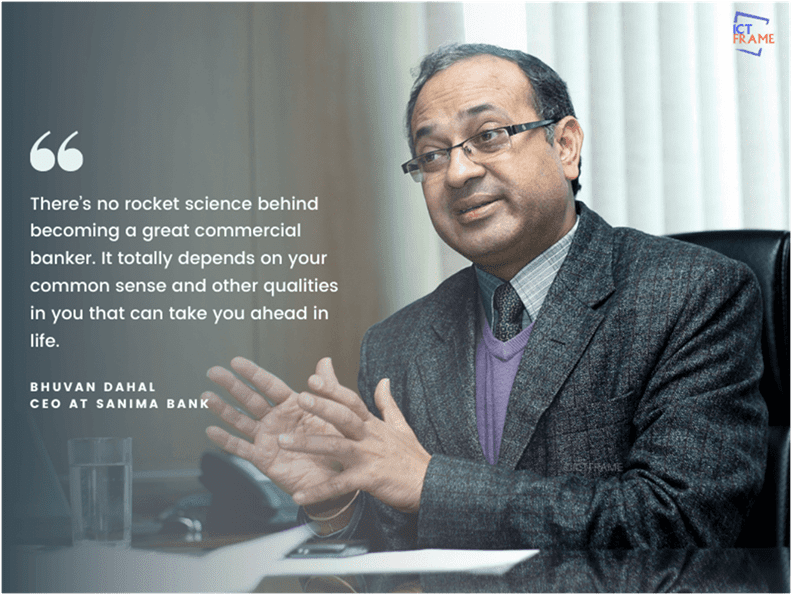

Interview with the CEO of Sanima Bank, Bhuvan Dahal

28th June 2020, Kathmandu

Banking is one of the most reputable jobs in every part of the world. But what does it take to be a banker? Is there a secret key to success?

Let’s get a better insight into the banking sector from the CEO of Sanima Bank, Mr. Bhuvan Dahal.

Q. Is it better to recruit internally or externally?

A: There are two entry-level recruitments in banks – junior assistant and management trainee. We recruit freshers for these positions externally. In the case of senior or experienced positions, we promote people internally to the extent practicable. It has both pluses and minuses.

Q. How do you manage risk in your personal life?

A: What’s certain about the future is that it is uncertain. So, risk and uncertainty are integral parts of life, be it personal or professional. I believe we have to measure the risks in life in order to move on by mitigating them.

We often use a phrase in banking which is ‘Take risks by choice, not by chance.’ Professionally speaking, we take risks based on assessment.

There are risks in every part of life and we can’t make its occurrence to zero. Therefore, I believe we need to measure the likely risks and take them at an acceptable level.

Q. What is the secret key to success in a banking career?

A: I believe I can only answer this question through my personal experience as every individual has their own path. For someone who started working at an early age of 18, I believe a person requires certain traits in order to succeed in life.

Firstly, it’s hardwork for sure. There should be no internal dispute regarding honesty and integrity of work. And, you have to be trustworthy because no matter how hard you may work, if your supervisor can’t trust you, you will have a lesser chance of getting promoted.

Another thing is perseverance. You have to be very patient!

Even if you work hard for something and give up too early, you can never succeed in life. In fact, ups and downs are parts of life. If a brief moment of success or failure influences your decisions drastically, then you won’t be able to maintain consistency. I believe communication also plays a vital role in determining success. If you have in-depth knowledge but you lack interpersonal skills to convey your knowledge, it will create hurdle in your path to success.

Likewise, It is also important to balance professional life and personal health & relationship. However, there is no straight forward formula for success.

Q. Does Nepotism and Favoritism exist in Job placement of the Banking sector?

A: In Nepal, not just in the banking sector, they exist everywhere as our society is in the morass of nepotism and favoritism. There are very few places where people believe in the system over getting in with the help of connections. Sanima is one of such few places.

Though we are extremely conscious to stay away from such vices and encourage a fair job placement for qualified people, there might still be some exceptions. However, I can say with confidence that if you are qualified and skilled, you are most welcome to apply to Sanima bank.

Personally, I don’t discriminate and favor a specific caste or race or gender or a relative as I believe all Nepalese are my relatives. we are all human beings and equal. Performance is the only differentiating factor. Thus, I have tried to implement a practice of zero nepotism since the beginning.

Q. What does it take to be a great commercial banker?

A: There’s no rocket science behind becoming a great commercial banker. It totally depends on your common sense and other qualities highlighted above in you that can take you ahead in life.

Besides that, you have to keep on acquiring knowledge and use common sense to take decisions. If you keep moving forward with good decisions, nothing can stop you. Thus, domain expertise is a must if you want to excel in anything that you pursue in life.

Q. What are your strengths and weaknesses?

A: (Laughs) Better this question is asked to others. Positive attitude. Fair and transparent working style.

Talking about my weaknesses, though I have a tight schedule, I try to make time for everyone. Often, it’s very tiring and not so feasible.

Another thing is that I am very blunt when it comes to giving my opinions which most people may not find comfortable. I speak politely but I never hesitate to tell the truth which most people don’t like.

Q. Bankers are willing to follow megamerger plans but want incentives. What are your thoughts on it?

A: I personally believe that mergers are good for Nepal looking at the massive number of financial institutions in Nepal. However, a merger is need-driven and can’t be forced. If investors feel that they are not benefitting from the investment, they consider a merger. Similarly, regulators may encourage weak banks for mergers.

Also Read: List of Merger and Acquisition of Banks in Nepal

Q. Banks continue to lend aggressively despite slow deposit growth. Please share your views on this.

A: If you take Rs. 100 deposit, you can lend Rs. 80 to earn more profit. When it comes to bank loans, it can generate employment and a higher growth rate in the economy. In fact, there are multiple plus points to this.

If banks could lend even 80% for the right cause and generate growth in the economy, it can benefit the country. If this aggressiveness is in a priority sector, then I must say this aggression is good.

Talking about the current circumstances, it will take some time to go back to the normal ways. However, the impact on businesses seems to be dissolving with the passing time.

You may also like to check out: